Precious metals in general did very well in 2020, and I expect them to keep pace in 2021, suggests Frank Holmes, CEO of US Global Investors, editor of Frank Talk and a participant in the MoneyShow Canada Premier Virtual Investor Conference on Feb. 2-4.

In our view, gold will continue to be supported by heightened efforts in the U.S. and elsewhere to transition from fossil fuels to renewable energy.

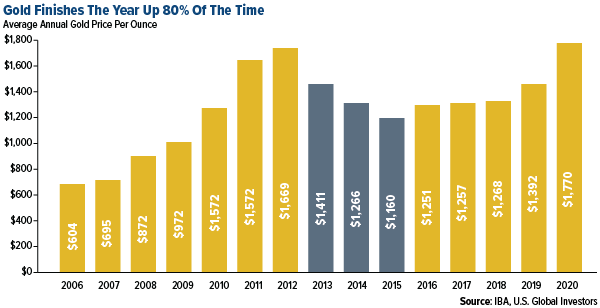

Gold bullion gained more than 25%, its best year since 2010. The surge in money supply due to pandemic stimulus helped fuel the rally. The amount of M1 money moving around the U.S. economy skyrocketed 66% from last year.

2020 marked the fifth straight year of positive gains for the yellow metal. In the past 15 years, gold has been up 80% of the time, a remarkable track record.

Silver was the best performing precious metal in 2020, up nearly 48%. Palladium and platinum were also strong performers, up 26% and 11%, respectively.

The biggest headwind in the fourth quarter of 2020 was positive vaccine news. Gold suffered its biggest drop in seven years in November when Pfizer announced it had developed an effective vaccine against COVID-19. The metal fell 5% on the day and ended the month below $1,800 an ounce.

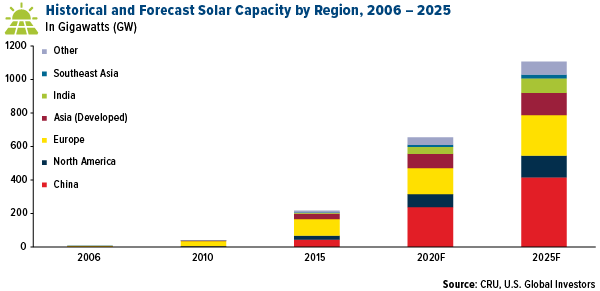

Silver is set to become a major beneficiary of emerging industrial applications. That includes sources of renewable energy, solar specifically, which continues to ramp up around the globe in response to a combination of carbon emissions legislation and a rapid decrease in the cost of “green” electricity.

President Joe Biden has made addressing climate change one of his top priorities and has ambitions to legislate a more rapid transition to clean technologies that favor not just silver but other metals as well.

According to a report by CRU Consulting, solar power generation will increase to 1,053 terawatt hours (TWh) by 2025, close to double the amount that was generated in 2019.

Amazon alone is planning five major solar projects around the world, including its first in China, as the retail giant seeks to reach 80% renewable energy by 2024 and 100% by 2030. Once completed, these five projects will generate 1.2 million megawatt hours (MWh) of energy every year, or enough to power 113,000 average U.S. homes.

I expect this to be a huge boon for silver, which is used to manufacture the all-important photovoltaic (PV) cells found in solar panels. Between now and 2030, PV manufacturers are projected to consume a staggering 888 million ounces of silver, according to CRU. To put that in perspective, that’s 51.5 million ounces more than the combined output from global silver mines in 2019.

But there are other technologies on the horizon that will require vast amounts of the white metal. The global rollout of 5G technology, still in the very early stages, will increase production for goods such as semiconductor chips, cabling, microelectromechanical systems (MEMS), Internet of things (IoT)-enabled devices — all of which require silver.

In 2019, the amount of silver used in the applications stood at 7.5 million ounces, or 0.75 percent of annual output. By 2025, that amount could more than double to 16 million ounces and, by 2030, triple to 23 million ounces, according to estimates by Precious Metals Commodity Management.

Gold could continue its rise in 2021 on low interest rates and higher inflation. Many remain bullish on the precious metals rally even after a volatile end to 2020.

Bloomberg Intelligence’s Mike McGlone says gold will be the asset to beat — predicting it will outperform stocks — due to greater quantitative easing and growing debt-to-GDP ratios.

I believe the juniors are going to start showing some good results. They raised about $2.5 billion collectively last year. We’re going to start getting more exploration results that could drive their share price.

Over the last two years, we saw the major gold miners consolidate and shed assets, but they also took some investment positions in select exploration companies. However, we didn't see any major mergers in the mid-tier gold mining space.

2021 could be the year of increased corporate activity leading to more growth and consolidation of assets. Acquisitions are likely to resurface, I believe.