The SPDR S&P Bank ETF (KBE) is an exchange-traded fund that invests in banks as an industry, specifically those financial companies that are included in the S&P 500, explains Jim Woods, editor of The Deep Woods.

This includes a variety of flavors, such as asset management and custody banks, diversified banks, regional banks and mortgage financiers. In practice, it is worth noting that regional banks are the most well represented by far in KBE’s portfolio because those are the most common type found in the index it tracks.

By equal-weighting, KBE ensures that even relatively smaller companies have a chance to impact the portfolio, potentially offering a little more risk than a market-cap-weighted fund would.

Like many broad-market ETFs, this one closely hugs its net asset value (NAV), so it is unlikely investors will overpay or underpay for it compared to a basket of the stocks it owns.

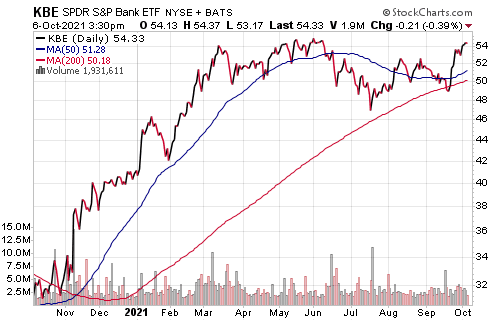

This fund has performed especially strongly in the last year as compared to other time frames. It is up 68% in that period, with much of that leap coming at the tail end of 2020.

Over most other possible durations, its performance is markedly less impressive. The fund pays about 2% in yield while costing 0.35% to own. That cost is typical for an index-based ETF.

Some of this fund’s holdings include Silvergate Capital Corp. (SI), Webster Financial Corp. (WBS), Sterling Bancorp (STL), Comerica Inc. (CMA) and Western Alliance Bancorp (WAL). Most of these are weighted at around 1.5%. There are slightly fewer than 100 holdings in the fund.

For investors looking for a way to profit from the banking sector at large without allocating huge chunks of their portfolio to the best-known giants, SPDR S&P Bank ETF may be a worthwhile fund to consider.