The energy market is facing a “Catch-22.” The shift to cleaner sources has put pressure on energy stocks while global supply chain shortages and periodic outbreaks of COVID-19 keeps boosting energy stocks, observes Jim Woods, editor of The Deep Woods.

As a result of this paradox, investors will likely remain interested in energy companies for the foreseeable future. One form of energy company that has received attention as of late is the master limited partnership (MLP).

Similar in some ways to real estate investment trusts, a MLP combines the tax benefits of a private partnership with the liquidity of a publicly traded company.

To qualify for such a designation (and the tax benefits that come with it), an MLP must generate at least 90% or more of its income from activities like the production, storage and transportation of natural resources.

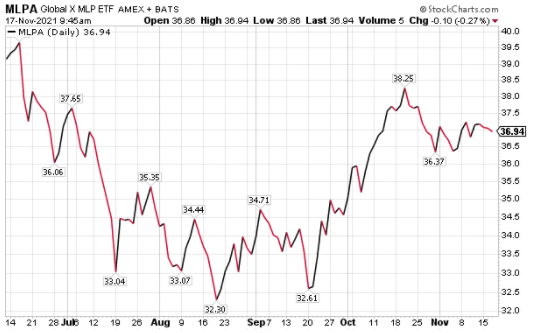

An ETF that is dedicated to MLPs is the Global X MLP ETF (MLPA). Specifically, MLPA is exclusively centered around 20 to 30 U.S.-listed midstream MLPs, but it is especially interested in companies that are involved with transporting, storing and processing energy products. Companies are weighted by market capitalization, and the index is rebalanced each quarter.

Currently, the fund’s top holdings include Enterprise Products Partners LP (EPD), Energy Transfer LP (ET), Magellan Midstream Partners LP (MMP), MPLX LP Partnership Units (MPLX), Genesis Energy LP (GEL), Plains All American Pipeline LP (PAA), Western Midstream Partners LP (WES) and DCP Midstream LP (DCP).

The fund has amassed $1.09 billion in assets under management and has an expense ratio of 0.46%. Its performance has been relatively strong, even when including the damage done by the COVID-19 pandemic. MLPA is currently up 47.77% year to date.

Chart courtesy of www.stockcharts.com

In short, while MLPA does provide an investor with a way to profit from MLP companies, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.