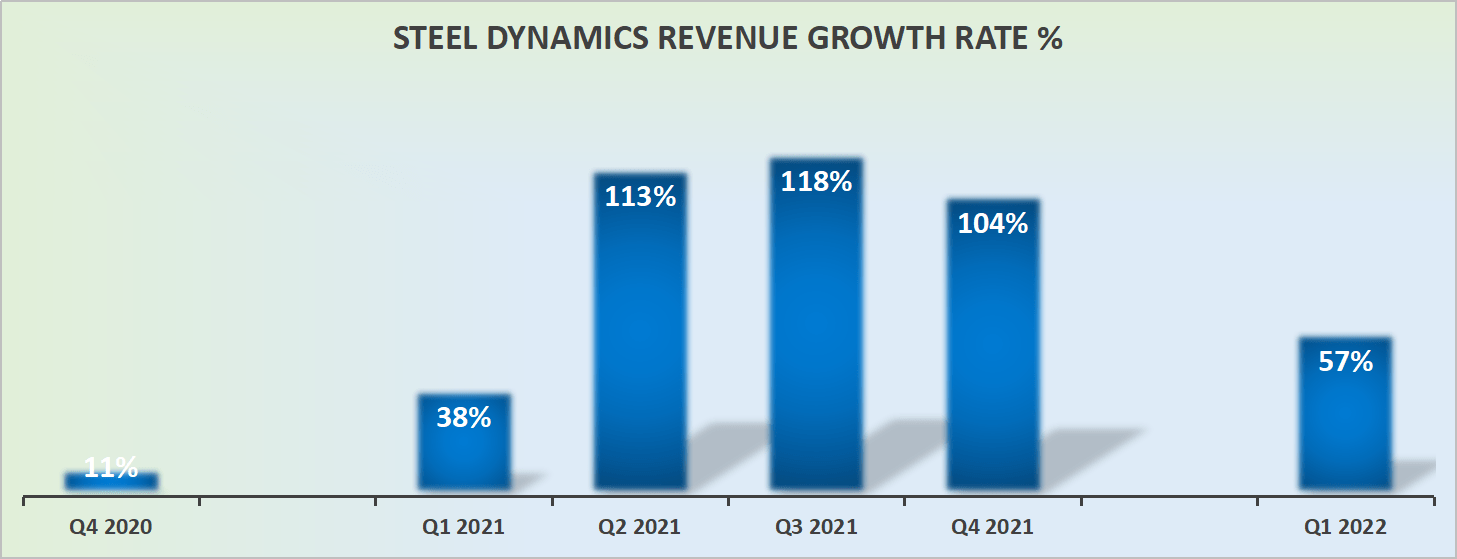

Steel Dynamics (STLD) is one of the largest steel producers and metal recyclers in the U.S., and it's pulling in record revenues and making record profits, observes Tony Sagami, growth stock expert and editor of Weiss Ultimate Portfolio.

For decades, the U.S. steel industry has been crippled by cheap foreign competition from Russia and China. Not anymore! Russia and China are the largest exporters of steel in the world, but sanctions on Russia and threats of trade sanctions against China mean steel imports into the U.S. have dried up.

As a result, Steel Dynamics is minting money. Just last quarter, the company generated $659 million of free cash flow. What did Steel Dynamics do with all that money?

- Increased its dividend by 31% to $1.36 a year.

- Spent $349 million on stock buybacks in Q1.

That increased dividend costs an extra $51 million a quarter plus the $349 million on stock buybacks last quarter, which means that Steel Dynamics spent 61% ($51 million of dividends + $349 million of buybacks) of its free cash flow on returning capital to its shareholder programs. That's what I call shareholder friendly!

For the year, Wall Street expects Steel Dynamics to generate over $3 billion of free cash flow, which means even more stock buybacks. Plus, at a current market cap of $16 billion, Steel Dynamics is trading for only 5.3 times that $3 billion of free cash flow.

That's cheap — especially for a stock that is sitting at the top of the Weiss Performance Rankings. Buy at market and place a protective stop at $70.