We are maintaining our “Buy” rating on Alphabet Inc. (GOOGL) with a target price of $125. Alphabet’s Google division continues to see weak advertising spending in a slowing economy. The ultimate duration of this weakness remains unclear. But whatever happens to the advertising market as a whole, we expect Alphabet to remain an important player, if not as dominant as it was some years ago, writes Joseph Bonner, an analyst with Argus Research.

We see Alphabet as one of the industry’s leaders, along with Facebook (META), Apple (AAPL), Amazon (AMZN), and Microsoft (MSFT). These companies have come to dominate new developments in mobile, public cloud, and big data analytics, as well as emerging areas such as artificial intelligence, virtual/augmented reality, and even quantum computing.

Plus, while Alphabet has often been criticized as a Johnny-one-note for its dependence on digital advertising, the rapid growth of Google Cloud has begun to diversify the company’s revenue.

Alphabet is beset by antitrust investigations and lawsuits both in the U.S and internationally. So, we think it may be close to impossible for Alphabet to make acquisitions in the current regulatory environment. The company faces headline risk from lawsuits and court rulings, and investor uncertainty regarding the outcome of these cases may create an overhang for GOOGL shares. Of course, the company also faces possible sanctions when regulatory and legal decisions are unfavorable.

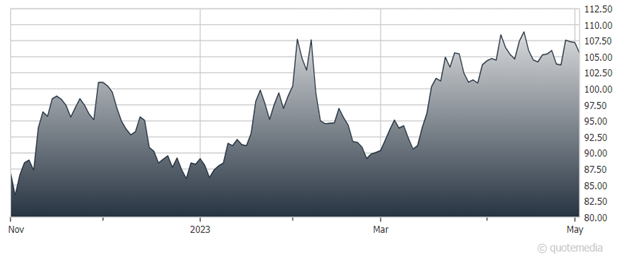

That said, the shares appear attractively valued given the company’s rapidly expanding businesses. Alphabet also reported 1Q23 results on April 25 after the market close, beating the consensus EPS estimate by $0.08. Alphabet provides no guidance, so large variances from consensus are typical. GOOGL shares have risen about 4% since the report.

Alphabet Inc. (GOOGL)

Consolidated net revenue rose an anemic 4% from the prior year to $58.1 billion (less traffic acquisition costs). Negative currency effects shaved three percentage points from revenue growth. Google’s 1Q23 advertising revenue, its primary revenue stream, was off just 0.2%, reflecting weak macroeconomic trends, as 2% growth at Search mostly offset declines at YouTube and Google Network — a sign of Search’s resilience even in a weak economy.

Both Apple’s ad tracking transparency changes and the economically driven slowdown in digital advertising have had a greater impact on YouTube than on Search advertising. Google Cloud showed solid though slowing 28% revenue growth (down from 44% growth in 1Q22), helped by the September 2022 Mandiant acquisition.

Management again noted on the call that Google Cloud saw slower growth in consumption as customers continue to cut back on cloud utilization. Cloud providers have always touted their ability to scale up workloads. However, in the current macroeconomic climate, customers may scale down just as quickly.

Google Other (Google Play, hardware, and other non-advertising businesses) posted 9% revenue growth, driven by growth in YouTube subscription revenue. In the small Other Bets segment, revenue rose 10% year-over-year to $288,000, in line with recent quarters. Traffic acquisition costs (TAC) fell 2.2% from the prior year.

Recommended Action: Buy GOOGL.