So, it happened. Rates around the world just went up. First it was the RBA last Tuesday, then it was the Fed on Wednesday, and then the ECB on Thursday. In the end, the tone remains negative, with concerns rising over what the next Fed move will be and what the economic data will tell us, explains Kenny Polcari, managing partner of Kace Capital Advisors LLC.

The Fed raised rates by 25 bps and left the door wide open – suggesting a “potential pause” but not committing to one. That allows them to go either way in June based on what we hear next.

JJ Powell went on to say that he thought the banks were just fine – this as investors/traders and algos continued to punish them. The S&P Regional Bank ETF (KRE) was already down 33% since the SVB crisis…it continued to get hit…and it fell another 13% before a Friday bounce.

The turmoil in the sector suggests that investors are not buying JJ’s assurances, nor are investors buying the banks’ assurances. Essentially, they’re saying that where there is smoke, there is fire. Ongoing rate hikes have hammered the bond portfolios of these banks with some estimating losses of $1.8 trillion.

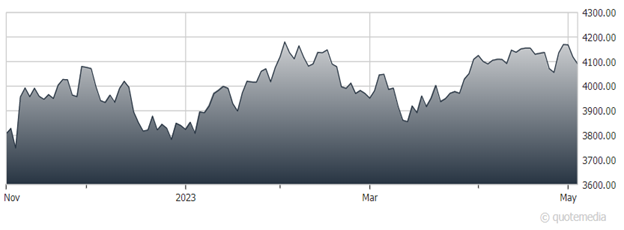

S&P 500

In other markets, oil continues to get slammed, having just broken down and through $70/barrel as the global recession story builds. The panic over rising rates and the coming recession is driving that narrative, but like I said, don’t be surprised to see what the Saudis do now. Remember, $80 is their sweet spot, so oil trading down to$69 only infuriates them.

This week will bring us the April CPI and PPI reports. Will they show an uptick in the inflation rate the way we have seen in both the UK and the EZ? And if they do, what does that mean for the Fed?

Remember the Fed is caught is between stubbornly high inflation and weakening eco data and that spells – STAGFLATION. That won’t be pretty.

I’ve been saying that the S&P feels tired to me…and that the recent high of 4,165-ish felt toppy. While we remain in the 4039/4200 range (support/resistance), I would not be surprised to see us retest the March lows of 3,800 before this is over.