We published a commentary in February entitled “The Proverbial Tug of War Between Fear and Greed Continues.” In that piece, I argued “The job market may not be as strong as January’s nonfarm payrolls suggested” and noted that the report is notoriously unreliable with frequent major revisions to past data and seasonal adjustments. Developments since then prove the point, writes Nancy Tengler, CIO at Laffer Tengler Investments.

The methodology is imperfect (and that is being kind), yet is relied upon as gospel until the next revision. We think the wage indicators are much more important — that is what drives inflation — and we have seen declines in just about every metric.

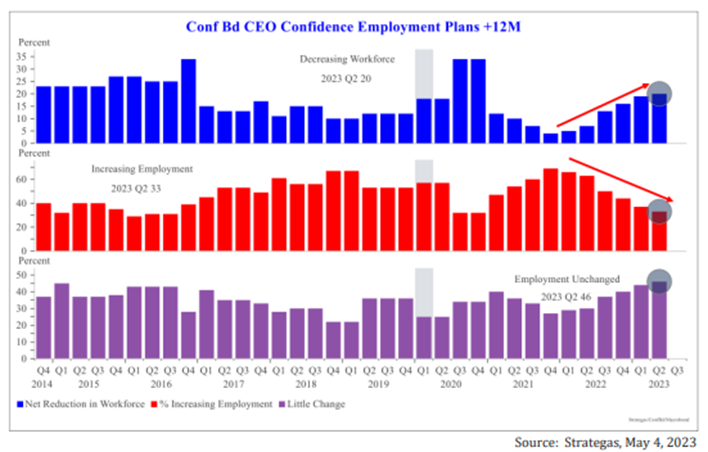

April’s revision to the non-farm payrolls (discussed above) proves our position and why we think the Federal Reserve is done. Or at the very least should be. And then there is this from Don Rissmiller at Strategas...

We have also suggested that May would be volatile and a great opportunity to add to high-quality, long-term holdings. That is exactly what we will be doing. The recently released nonfarm payrolls number came in much hotter than expected and the pundits IMMEDIATELY declared that the Fed had to continue hiking.

No mention was made of the revision down the previous month. But the market took note and after an initial sell-off in the futures market, stocks resumed the rally that came on the heels of a better-than-expected earnings report for Apple (AAPL).

The folly of chasing each daily data point is clear. The market is a forward-discounting mechanism and these numbers are backward looking and subject to revision. (Please note Fed voting members!) The trouble all began when they decided to eschew economic estimates and became what they call “data dependent.”