Walgreens Boots Alliance Inc. (WBA) is the largest retail pharmacy in both the US and Europe. Through its flagship Walgreens business and other business ventures, the $30 billion market cap company has a presence in nine countries and about 13,000 stores in the US, Europe, and Latin America, elucidates Ben Reynolds, editor at Top 10 Dividend Elite.

The company operates several brands, with Walgreens and Duane Reade collectively making up the vast majority of locations. Walgreens generates about $133 billion in annual revenue.

The company reported $1.5 billion in after-tax proceeds from its partial sale of holdings in AmerisourceBergen (ABC) during the second quarter of fiscal year 2023. On March 28, Walgreens reported second-quarter fiscal 2023 results for the period ending February 28. Sales grew 3.3% during the quarter to $34.9 billion. This figure was up 4.5% on a constant currency basis.

Earnings-per-share equaled $0.81, which was down 20.3% from the prior year. On an adjusted basis earnings-per-share equaled $1.16, down 25.8% from $1.59 in the year ago period. Adjusted earnings-per-share did top analysts’ estimates by $0.05, marking the eleventh consecutive quarter of beating consensus estimates.

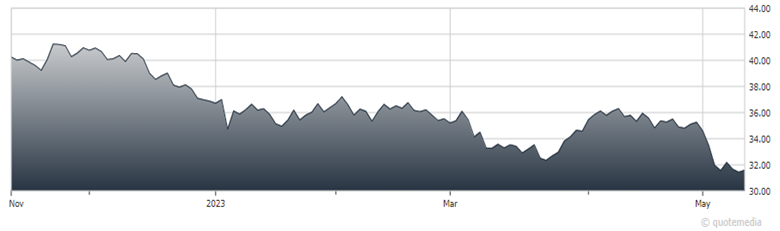

Walgreens Boots Alliance (WBA)

Walgreens also reaffirmed its fiscal 2023 guidance. For this year the company anticipates $4.45 to $4.65 in adjusted earnings-per-share (unchanged from previous) and sales of $133.5 billion to $137.5 billion. We are anticipating $4.55 in adjusted earnings-per-share this year.

Walgreens’ competitive advantage lies in its vast scale and network in an important and growing industry. In the Great Recession, earnings-per-share slipped only 7% and the dividend kept rising. The stock is offering a dividend yield of 5.7%.

Given the healthy payout ratio of 42% and the resilience of the company to recessions, the dividend appears safe. Walgreens has increased its dividend for 47 consecutive years.

Walgreens has grown its earnings-per-share by 7.6% per year on average over the last decade. This was driven by a combination of factors including solid top-line growth (7% average annual growth), net profit margin expansion, and a modest reduction in the number of shares outstanding. Over the intermediate term, we are using a 4% anticipated growth rate, expecting some sort of recovery from this year’s somewhat low expected comparison base.

Shares were recently changing hands at 7.4 times our estimate of 2023 earnings. Our fair value multiple is 10.0 times earnings, indicating the potential for a 6.5% annual tailwind from the valuation. When combined with the 5.7% starting dividend yield and 4% anticipated growth, this implies the potential for 14.8% in annual total returns.

Recommended Action: Buy WBA