Imagine that you bought a snowplow business, and then it just weirdly stopped snowing for a year. That would be frustrating and is what actually befell owners of Douglas Dynamics (PLOW) recently, writes Doug Gerlach, editor of Investor Advisory Service.

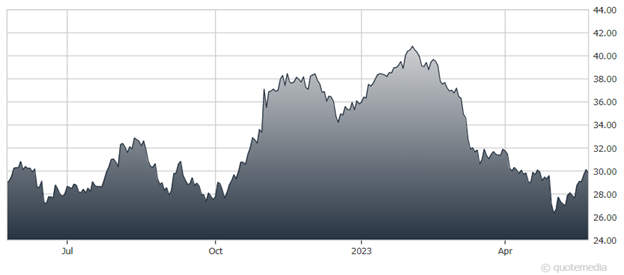

The stock market is treating shares like winter snowfalls were just a passing fad. In reality, one year of disappointing weather does not matter to the company’s long-term ability to generate earnings and cash flow for shareholders. This feels like an opportunity to buy low.

Headquartered in Milwaukee with facilities throughout the Midwest and Northeast, Douglas Dynamics manufactures and installs snowplows and other work truck attachments. The plow business is extremely seasonal. The recent winter failed to produce its typical seasonal uplift because the geographies where Douglas is concentrated received anomalously low snowfall. This caused financial results to miss estimates in both the fourth quarter of 2022 and first quarter of 2023.

Douglas Dynamics (PLOW)

All the company could do was cut costs to try to limit the damage, implementing what management calls its “low snowfall playbook.” Having recently reported its largest first quarter loss ever, even larger than the first quarter of 2020 which effectively lost an entire month to pandemic shutdowns, shares are now down by approximately half compared to their pre-pandemic high and are currently at a level the stock first achieved back in 2016.

Weather fluctuations notwithstanding, the snow removal market grows at about the pace of overall GDP, with incremental growth opportunities coming from acquisitions and product line extensions. Forays outside of snow and ice removal have not been very fruitful, but the company succeeds when it stays in the lane of its niche market.

Next year’s snowfall will probably be more normal, and the company’s results will bounce back. In the meantime, Douglas is deriving strong results from its Solutions segment. Solutions was 38% of 2022 revenue and includes heavy duty truck upfitting for municipalities and utilities companies.

This segment has a longer sales cycle and operates with a sizable backlog that helps smooth out results. While snowplow sales declined by more than half year over year in the recent quarter, Solutions sales increased 11%, and management believes that high levels of remaining backlog will lead to continued strong growth.

We model 10% compound EPS growth, which would generate EPS of $2.63 in five years. That figure, combined with a high P/E of 26, generates a potential high price of 68. For a low price, we apply a low P/E of 17 to trailing twelve month EPS of $1.22 and get 21.

On that basis, the upside/downside ratio is 5.7 to 1. Adding dividends, the total return could be as high as 21%, with an average projected total return of 17%.

Recommended Action: Buy PLOW.