We recently added one cell tower proprietor to our Growth Utilities stable. Now, the reversal in interest rates means that 2022’s headwinds will turn into 2023’s tailwinds for the sector. So why stop at Crown Castle (CCI)? Consider adding SBA Communications (SBAC), too, exclaims Brett Owens, editor of Hidden Yields.

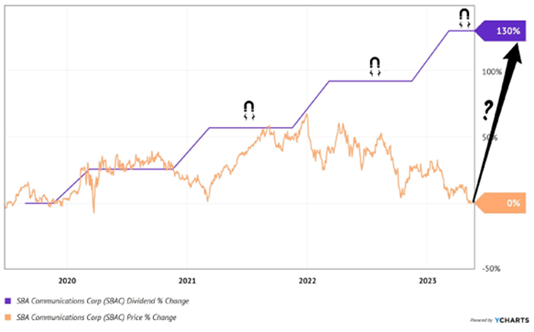

SBAC is the new kid on the scene. The company IPO’d in 2019. SBAC has already increased its dividend by 130%.

The stock, as you’d imagine, was on a tear. But then 2022 hit, rates rose, and SBAC sank along with other REITs. Management kept paying its dividend, raising it annually, but it didn’t matter. The rate freight train temporarily flattened SBAC shares:

Cell towers are a costly business to build out, but a fantastic one to run. It’s expensive to erect a tower, but then the wily operator can add a second and third tenant to the tower at a minimal incremental cost. Thus, the return on investment (ye ol’ ROI) becomes better and better over time!

SBAC’s dividend reflects this but its stock price does not. Thank you, higher rates, for giving us a rare opportunity to buy this company in the bargain bin.

SBAC is the third-largest wireless tower operator in the US, “competing” with CCI and American Tower (AMT). I say “compete” in jest because the industry is more like an oligopoly, with plenty of business to go around. Sweet!

While AMT and CCI have expanded internationally, SBAC still does three-quarters of its business in the US. It’s more of an American “pure play” on cell phone usage. Because the US is considered a more secure market, SBAC stock is usually the most expensive of the trio, often demanding more than 30-times funds from operations (FFO). (FFO is the “go to” cash flow metric for REITs.) Not cheap.

But today is different. Over the past 12 months, SBAC earned $10.58 in FFO per share, which pegs shares at 22-times FFO. While not dirt cheap at large, it’s about as inexpensive as we’ll ever see SBAC, especially with rates on the way back down.

Recommended Action: Buy SBAC.