The most resilient and higher-growth midstream companies tend to deal in natural gas and natural gas liquids (NGLs). Natural gas is by far the cleanest burning and fastest-growing fossil fuel source in the world, and the US is the world’s largest producer. The Williams Cos. (WMB) is one beneficiary I like, shares Tom Hutchinson, editor of Cabot Income Advisor.

Williams is an American midstream energy company involved in the transmission, gathering, processing and storage of natural gas. It operates the large Transco and Northwest pipeline systems that transport gas in densely populated areas from the Gulf to the East Coast. Roughly 30% of the natural gas in the U.S. moves through its systems.

The bulk of adjusted EBITDA comes from pipeline transmissions plus a smaller deep-water presence in the Gulf of Mexico (47%) and gathering and processing facilities (38%). The rest is from marketing and NGL (natural gas liquids) services, exploration and production joint ventures, and oil gathering and processing.

The company has minimal commodity price exposure, as most revenues are fee-based and secured under long-term contracts with inflation adjustments. It’s also well worth noting that the company acquired the remaining 26% ownership from its limited partner and is now a regular corporation (not a Master Limited Partnership). Therefore, dividends are taxed at the maximum 15% rate (or 20% in some cases) and the investment doesn’t generate a K-1 form at tax time.

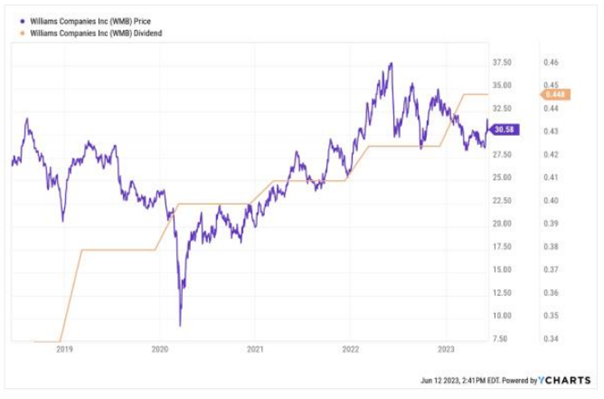

WMB returned over 30% in 2022 while the market was down more than 19% for the year. But the market neglect of defensive and energy stocks in the early part of this year has reversed things. WMB is down more than 4% YTD (as of June 12).

Even after the crummy first half of the year, WMD has still averaged better than an 18% per-year return over the last three years. Williams has been able to achieve a higher level of earnings growth than its peers because it is reaping the reward of $8 billion invested in new projects over the last few years.

Williams currently pays out $0.4475 per share quarterly, or $1.79 annually, after raising the payout by 5.1%, which translates to a current yield of 5.9%. While the company has paid a quarterly dividend since 1974, it hasn’t always raised or maintained the payout.

The company slashed the dividend in the aftermath of the 2014 oil price crash. But it has since restructured in a way that makes the current dividend far safer. Williams restructured to a regular corporation in 2018. It has since reduced its net debt-to-EBITDA by 21% while investing $8 billion in new projects with an 18.8% return on capital between 2018 and 2021.

Recommended Action: Buy WMB.