We are reaffirming our “Buy” rating on McKesson (MCK) with a revised price target of $450, raised from $430. The company is working to grow its customer base post-pandemic as it adds new capabilities and technologies, and divests underperforming assets (including most of its European distribution operations), highlights David Toung, analyst at Argus Research.

As one of the nation’s largest distributors of pharmaceuticals and medical-surgical products, McKesson is benefiting from a recovery in patient visits to physicians’ offices (which has boosted volume for both diagnostic tests and prescriptions) as well as from an increase in elective surgical procedures.

McKesson reported strong fiscal 4Q23 results on May 8. Adjusted EPS rose 23% from the prior year to $7.19 and topped the consensus estimate by $0.03. GAAP net income rose to $787 million or $5.71 per share from $370 million or $2.48 per share a year earlier. Revenue rose 4% to $68.9 billion.

The contribution to EPS from COVID tests (including assembly, storage, and distribution) fell to $0.16 from $0.42 a year earlier. Excluding this contribution and gains from McKesson Ventures, adjusted 4Q23 EPS rose 29.7% from the prior year.

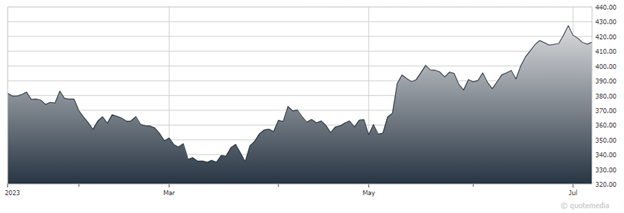

McKesson (MCK)

Top-line growth was driven by strength in US Pharmaceutical Distribution, partly offset by lower revenue in the Medical-Surgical and International businesses (the latter due to the exit from distribution operations in 11 of 12 European countries). US Pharmaceutical revenue rose 15% from the prior year to $61.7 billion, driven by an increase in the volume of specialty drugs, partially offset by branded-to-generic conversions. Segment operating profit rose 8%.

In Prescription Technology Solutions, revenue rose 13%, driven by higher prescription volume in the third-party logistics business and increased demand for technology services. Segment profit rose 35%, driven by growth in access, affordability, and adherence solutions.

In the Medical-Surgical segment, revenue declined 6% to $2.7 billion. This was driven by lower sales of COVID-19 tests and related supplies, partly offset by growth in the primary and extended care businesses. Segment operating profit declined 17%. Excluding the impact of COVID-related items, segment profit grew 2%.

For FY23, adjusted EPS rose 9% to $25.94. GAAP net income was $3.563 billion or $25.05 per share, up from $1.119 billion or $7.26 per share a year earlier. Revenue increased 5% to $276.7 billion. Excluding contributions from COVID-related sales and gains from McKesson Ventures, adjusted EPS rose 14.7%.

Recommended Action: Buy MCK.