It’s anybody’s guess what the second half will have in store for the market. But I have recommended several cyclical stocks that will benefit in a good second half for the market, as well as defensive positions that will benefit if the rally broadens or the market goes sideways in a slowing economy. One name I like is Realty Income Corp. (O), writes Tom Hutchinson, editor of Cabot Income Advisor.

The first half surprised almost everyone with a stellar 16% gain in the S&P. Investors are sensing a soft landing, whereby we get past this Fed rate hiking cycle without a recession and minimal economic pain.

Recent economic numbers reflect a greater likelihood of that scenario. Anything is possible. The market could be off to the races, or it could sober up and pull back. Inflation is falling while the Fed is still making hawkish noises. It’s reasonable to assume that even if the economy isn’t slowing down yet, the Fed will continue to raise rates until it does.

It will be difficult for stocks to add much to the near 24% rally since the October low ahead of a slowing economy and still contracting corporate earnings. But the artificial intelligence mania could drive technology stock prices higher despite the economic cycle and buoy the market.

Realty Income (O)

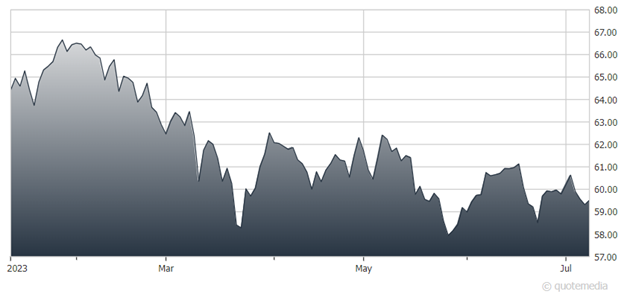

Meanwhile, with a recent yield of 5.1%, Realty Income is a legendary monthly income stock. It is in one of two underperforming sectors in the first half, Real Estate and consumer staples. It currently sells well below the pre-pandemic high, despite having higher earnings, and the stock is now near the lowest point since last summer.

But income and safety may be at a premium in the second half of the year. Either investors will crave defense again or the rally will broaden out to include this year’s lagging sectors.

Recommended Action: Buy O.