Not long ago, during a routine Tahoe hike, I executed a perfect face plant. The doctor told me my nose served as an airbag protecting the rest of my face. Why bring it up? Because I learned a perfect landing is possible, if not somewhat painful. Now, let’s talk about if that will be possible for the US economy, says Nancy Tengler, CIO at Laffer Tengler Investments.

Yes, the snout was broken—shattered may have been the word he used—but the eye sockets, my jaw, teeth—were all intact. They stitched me up, waited for the swelling to go down and then he reset the bent beak and I am back in business.

In the US economy, inflation is dropping like a rock, and we are nine months into a new bull market. Thanks to Don Rismiller’s work, we have pointed out for a year that inflation rises and falls in a mostly symmetrical manner, and that we hit peak inflation in June of 2022 when CPI breached the 9% summit.

Ten months ago, our logic concluded that if inflation peaked in June, the Fed was closer to the end of the rate hike cycle than the beginning. We believed that was bullish for stocks.

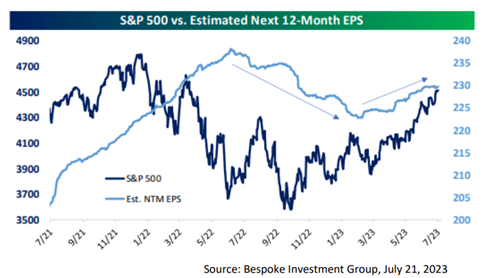

Many were hiding in defensive names (and still are). But we continue to like this risk-on rally (which is not to say there won’t be volatility—we would buy the dips) in technology, industrials, energy, and sections of consumer discretionary for many reasons including the most important: Earnings estimates are on the rise.

As our old friend Larry Kudlow says, earnings are the mother’s milk of stocks. With the rally so far mostly due to multiple expansion, rising earnings estimates are needed to drive stocks further and sustainably.

BTW: Many are arguing that the rally is not reliable since only seven or eight stocks have driven this bull—no breadth. But it is important to note that 80% of stocks just traded above their 50-day moving average for the first time this year. The rally is widening out.

Soft landing? Hard landing? The perfect landing? No one knows. But it doesn’t stop the pundits from spilling ink and consuming airtime speculating and opining.

I am not sure it matters. Companies have surprised Wall Street again this earnings season. Revenues and earnings are surprising to the upside more than not and even margins are showing signs of life. With PPI (the input costs) having led CPI up and (now) down, savvy management teams are preserving and even expanding margins modestly.

It is just possible that the economy stuck the perfect landing. Or may still land. As I learned recently, the perfect landing may not be without pain--but it may be as good as we get. And that may be enough.