July closed with a fury. Two summer storms rattled our small farm. Meanwhile, the markets enjoyed some fury of their own in the closing days of July. But the damage being done was to shorts. The question now, will it continue? Here is my take, notes Matthew Carr, editor of Tipping Point Profits.

The winds kicked down an ancient tree across our road.Then they came back hours later and shoved over three more that were weary from the fight the day before.

Fortunately for us – despite some blisters on my hands from hacking away at the fallen timber with my axe and chainsaw – the damage was slight. The only real casualties (beside the trees) were a couple of cross boards in the paddock fence that took the brunt. And those were on my “honey-do” list to replace anyway.

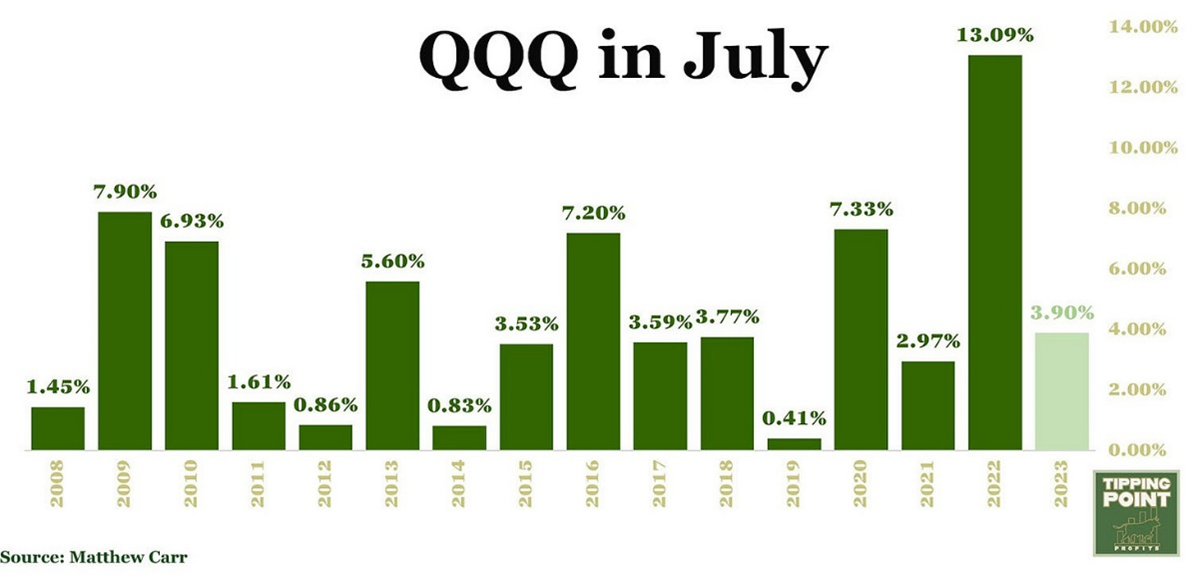

As for markets? At the start of July, I penned an essay Why I’m Buying the Dip in Tech. In it, I outlined how the Invesco QQQ ETF (QQQ) was down 1.37% at the time...but that July is home to one of the friendliest trends for the sector.

We can see that for 15 consecutive years, the Qs had leapt higher in the month. And in 2023, they made it 16 straight years of green.

So, what’s next for tech? I’ve pounded the table that there’s no “summer lull” for tech stocks. That each year, the QQQ begins a run in March and it often doesn’t slow until September.

Well, in 2023, the last down month for the Nasdaq 100 was February. We’ve now enjoyed five consecutive months of gains. That’s despite all the negative headlines over a regional banking crisis, continued calls for a looming recession, and an ongoing earnings recession for the S&P 500. Not to mention the war in Ukraine, deadly heatwaves gripping the US, and the initial rumblings of the 2024 presidential campaign season.

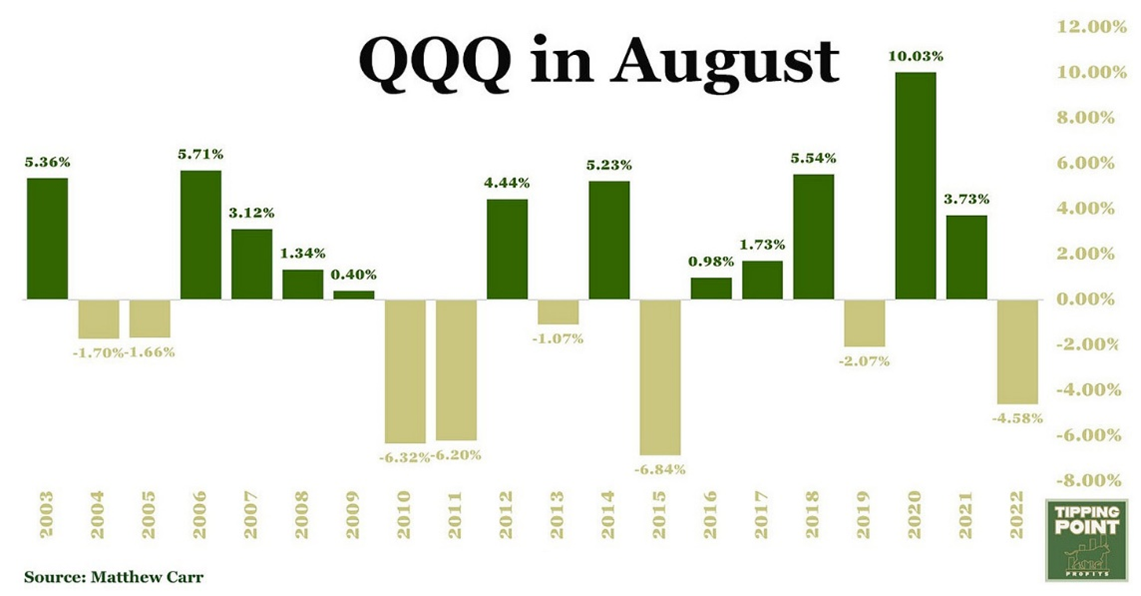

The good news is that, historically, August tends to be another solid month for the Qs. But the trend is nowhere as clean as what we see in July…

Over the past 20 years, the proxy for the Nasdaq 100 is averaging a 0.86% gain in the month. That earns it the title of the sixth-best month for tech. And we can see from the chart above, the Qs have only ended August in the red eight times during that 20-year span. That translates to a 60% success rate.

In other words, it’s not a shoo-in for gains like July. But traditionally, with second quarter earnings numbers continuing to roll in, we have some wind in our sails through August. Call me “Optimistic with a dash of caution.”