Walmart (WMT) and other big retailers are on deck to report earnings this week. News from these companies should demonstrate how consumers are holding up in this period of high interest rates. Meanwhile, our research shows some interesting trends in select sectors, writes John Eade, president of Argus Research.

Investors also will continue to ponder the inflation data that came in late last week. The Dow Jones Industrial Average was up 0.6% last week, the S&P 500 shed 0.3%, and the Nasdaq lost 1.9%. Year-to-date, the DJIA is up 6%, the S&P is up 16%, and the Nasdaq is higher by 30%.

Each month we take a close look at an aspect of sector investing. This month, we are examining growth and valuation.

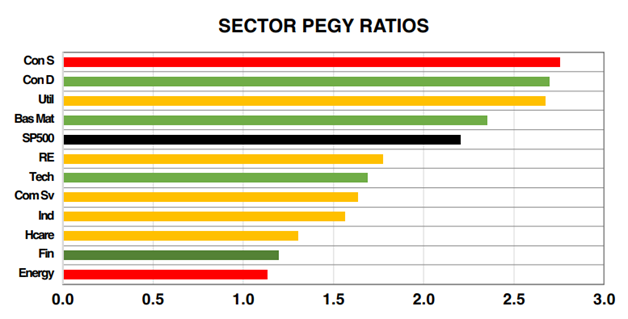

Investors hunting for stocks that reasonably balance long-term growth prospects and current value characteristics might want to look at companies in the Financial Services, Technology, and Industrial sectors. These are among the industry groups that currently are selling for PEGY ratios (price/earnings)/(growth+- yield) at or below the S&P 500’s ratio of 2.2.

To generate the PEGY ratios, we use the P/E ratio for each sector based on forward earnings for the numerator. For the denominator, we average the growth rates for the past five years along with two years of forward estimates, this in order to achieve a smoother, less-volatile, earnings growth rate trend. We then add the current yield in order to approximate total return.

As an example, the current S&P 500 P/E ratio is 19, the current yield is 1.6%, and the forecast five-year growth rate is 7.0%. The formula is 19/(1.6+7.0), which equals 2.2.

Premium-valued sectors with low growth rates include Consumer Staples and Utilities. Based on our analysis of growth rates and valuations, along with other factors, we have established current over-weight sectors as Technology, Financial, Consumer Discretionary, and Basic Materials.

Our under-weight sectors are Energy and Consumer Staples. Our Market-Weight sectors are Healthcare, Communication Services, Utilities, Real Estate, and Industrials.