Big utility dividends are likely to be the darlings of 2024. Which is why we’re loading up on them now. As the economy eventually slows down, interest rates will drop. That’s bullish for “bond proxies” like utility stocks. Dominion Energy (D) is the cheapest blue-chip utility on the board today, highlights Michael Foster, editor at Contrarian Income Report.

Utility dividends. That’s about as old school as it gets, and it’s exactly what we want to target as this much-anticipated recession arrives! We’ll dust off our grandparents’ investing playbook.

As for D, it’s in the dividend doghouse because the company cut its payout in late 2020. Why the chop? Too much debt, of course. Dominion had embarked on an acquisition binge in the name of growth. Which, ironically, backfired.

The result was a rare payout slash from a utility—an income investor’s worst nightmare. That’s why first-level investors keep Dominion in the doghouse today.

Which intrigues us here at Contrarian Outlook. Did we hear doghouse? And a dividend cut in the rear-view mirror? You have our full attention, D!

Chief financial officers (CFOs) are like carpenters. It’s best to measure twice and cut only once. As a result, the safest dividend is often the one that has recently been cut. Unless management is a complete clown show, the last thing they want is to have to cut twice.

Which is why the recent dividend raise from Dominion is encouraging. It shows confidence that the current dividend is being paid comfortably. Dominion now yields 5%. It rarely pays this much.

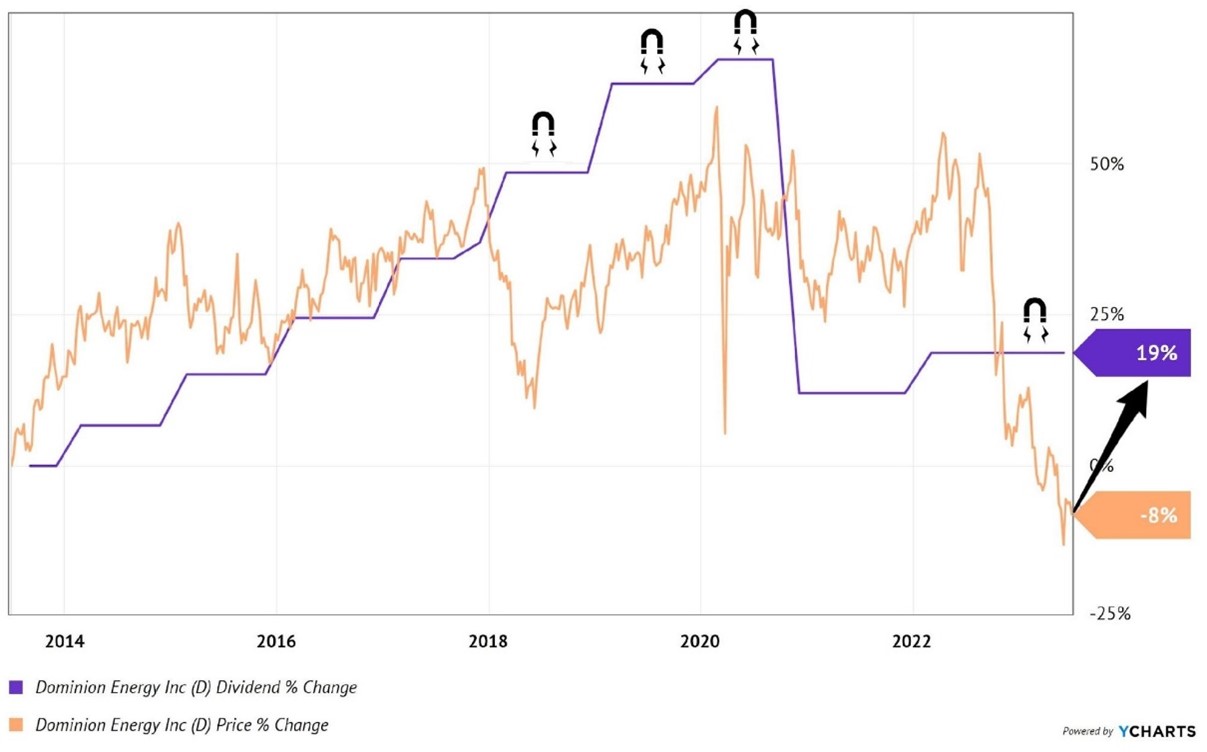

From a “dividend magnet” standpoint, the stock has more upside from here. Over the past 10 years, even net of the cut, Dominion’s dividend is up 19%. Not great, but the stock has been unfairly punished. From a price-only standpoint, the stock trades below where it did a decade ago!

Over the long run, stock prices track their payouts—higher and lower. They can overshoot and undershoot for months, sometimes years at a time. Eventually they find their way home.

As we speak today, Dominion’s price lags its payout. Which is why we want to lock in its 5% yield. We’ll enjoy a bit of upside, too, when this stock eventually gets up off the mat.

Recommended Action: Buy D.