We are flirting with new highs on the 10-year Treasury yield for 2023. Unlike 2022, the stock market – and the tech sector in particular – had been ignoring creeping bond yields of late, but it has started to notice, explains Ivan Martchev, investment strategist at Navellier & Associates.

The NASDAQ 100 closed below its 50-day moving average for the first time since March recently, and any further progress in creeping bond yields is likely to put pressure on the stock market and tech sector in particular.

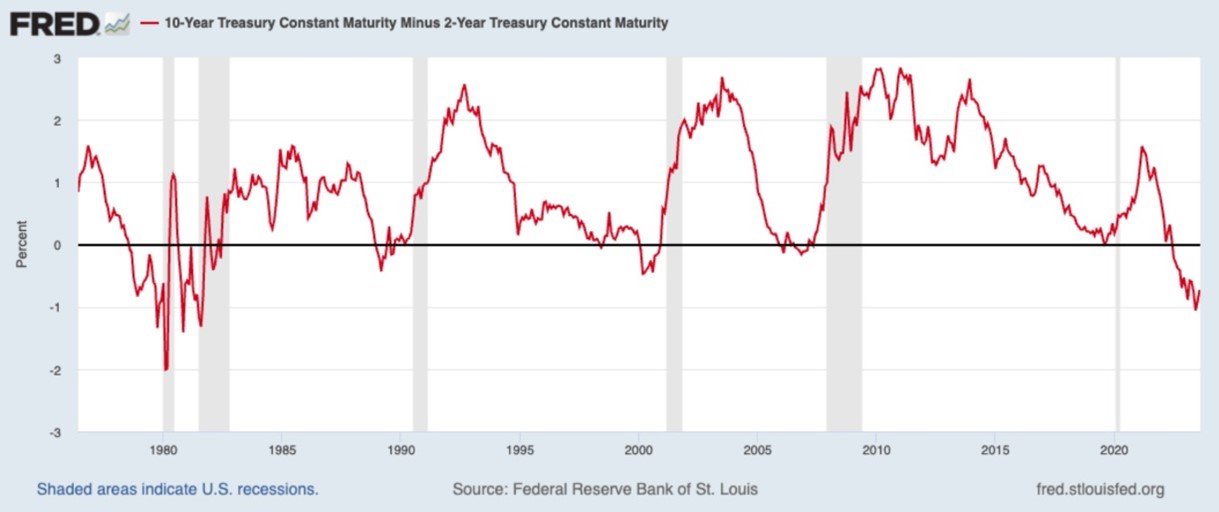

I didn’t think we would see the 10-year at 4.20% in 2023, but so far the bond market (and the economy) has surprised me (and most others) with its resilience. The yield curve inversion has fallen from -108 bps in late July to -73 as of this writing. A mere 35 bps may not seem like much, but it is a huge move in a short period of time – bigger in magnitude than the decline in stock prices in the past two weeks.

They say that after being deeply inverted, a sudden steepening of the yield curve is an ominous sign. The biggest changes after inversions happened during the last six recessions (see the chart above). The problem is, we are not in a recession and the yield curve was almost as inverted as when Volcker intervened in 1979-82.

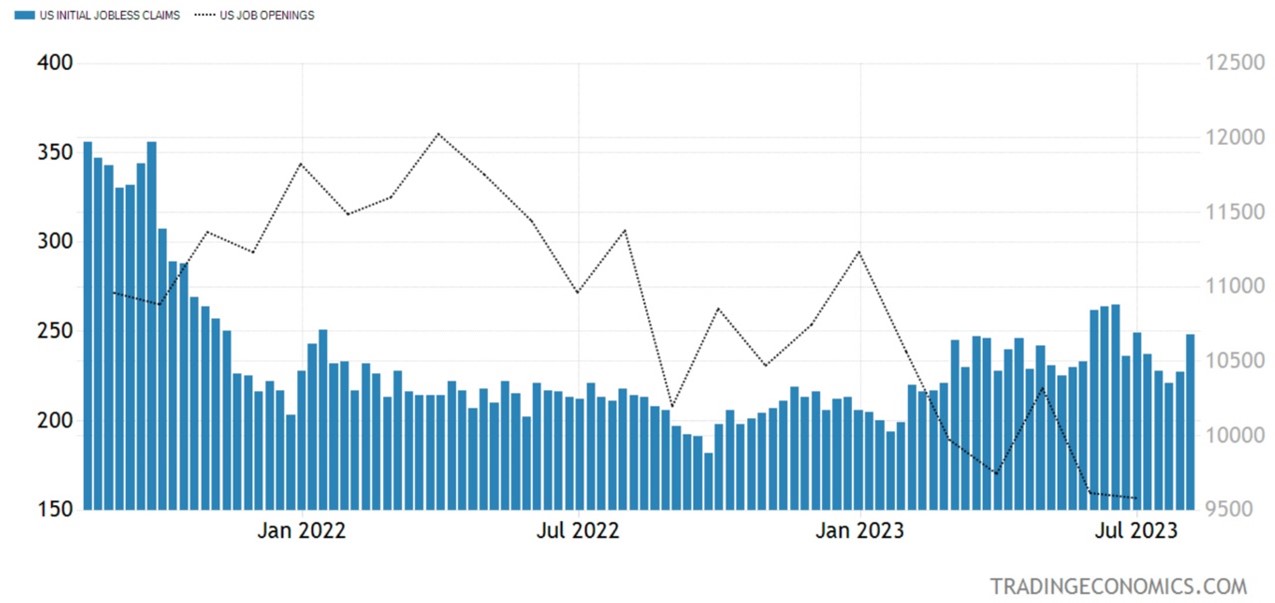

If the US economy were weakening, Treasury yields should not be rising, as the bond market would sniff it out ahead of time. Jobless claims are called the “desert island indicator,” since if an economist were to be stranded on a desert island and had to take the pulse of the US economy and could ask for only one economic indicator, jobless claims would be it.

But while jobless claims spiked recently to 248,000, they are still considered low by historical standards. Job openings have declined notably, yet the jobless rate has not risen, which right now puts the fate of the economy in the elusive category of “soft landing.”

The only other soft landing in recent memory was in 1994-95, when Alan Greenspan raised rates six times and it was clear there would be no recession, and the stock market surged dramatically in 1995. Could this be another such soft landing? Right now, a soft landing looks more likely than it did just six months ago.