inTest Corp. (INTT) is a supplier of test and process technology solutions for both the front-end (end users) and back-end (manufacturers) in and related to the semiconductor industry. Key target markets include makers and users of products in the automotive, defense/aerospace, industrial, life sciences, and security industries, explains Doug Gerlach, editor of Small Cap Informer.

There is no mistaking the pandemic’s impact on manufacturing and shipping worldwide. The resulting mismatch of supply and demand for many types of technological products and materials wreaked havoc across many markets.

The semiconductor industry in particular seemed to experience much agony in trying to produce and deliver its products to customers. Exacerbating the supply issues, demand for many types of semiconductors has been exploding as a result of AI, cloud-based computing, the Internet of Things, and continuing adoption of wireless technologies, to name a few of the trends lifting the industry.

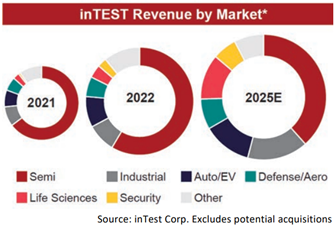

These needs have created opportunities for growth for many smaller companies, a number of which we have covered. This month we introduce INTT, another small player in the semiconductor equipment industry. The company possesses the right combination of growth prospects (both organic and via acquisition) and reasonable valuation. Its diversification strategy, though, offers opportunities not as directly tied to the semiconductor manufacturing segment of its industry.

Customers include Texas Instruments, Emerson, Lockheed Martin, Raytheon, Qualcomm, and Analog Devices. In fiscal 2022, no customer accounted for 10% or more of revenue, while its ten largest customers accounted for approximately 43% of revenues. The company operates in three segments: Electronic Test, Environmental Technologies, and Process Technologies.

Customers include Texas Instruments, Emerson, Lockheed Martin, Raytheon, Qualcomm, and Analog Devices. In fiscal 2022, no customer accounted for 10% or more of revenue, while its ten largest customers accounted for approximately 43% of revenues. The company operates in three segments: Electronic Test, Environmental Technologies, and Process Technologies.

Analysts who follow inTest expect EPS to grow around 15% annually in the next five years. Company guidance is for third quarter 2023 EPS in the range of $0.20 to $0.24. For fiscal 2023, the consensus estimate is for EPS of $1.15, a 34.6% gain over fiscal 2022.

In its second quarter 2023 earnings release, management updated its guidance for current year revenues to $127 million to $131 million. Revenues for 2023 are estimated on the Street to grow around 10.9%, which would include some continual margin improvements.

Our long-term estimate is 12% for both EPS and revenues on an annualized basis through 2027. This gives us a margin of safety if results come in a bit below that; conversely, if the analysts’ estimates prove more correct, then there could be a bit more upside for inTest shares.

Through 2027, the share price appreciation we calculate is 19.9% on average per year. Given our conservative judgment in valuation metrics and expected growth, there could well be additional upside for inTest.

Recommended Action: Buy INTT