We are reiterating our “Buy” rating on Phillips 66 (PSX) and raising our price target to $134 from $125 per share, implying a total return potential of about 19% from recent prices, including the dividend, writes William Selesky, analyst at Argus Research.

In the current volatile energy market environment, we believe that a company’s balance sheet strength and place on the cost curve are critical, and favor those refining and marketing companies that are well positioned to manage their businesses in a range of oil price scenarios.

We believe that PSX is one of these companies as it benefits from its size, scale, and diversified business portfolio, which includes refining, midstream, chemicals, and marketing and specialty operations. This diversification has made the company’s cash flow less volatile than that of most pure-play refiners. PSX also has a long history of returning excess cash to shareholders through buybacks and dividends.

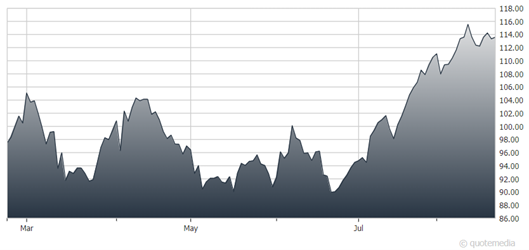

Phillips 66 (PSX)

On August 2, Phillips 66 reported a 2Q23 adjusted net profit of $1.766 billion, or $3.87 per share, down from $3.285 billion, or $6.77 per share, in 2Q22. EPS fell modestly short of our estimate of $3.94 but beat the consensus estimate of $3.54 per share. The lower earnings were largely attributable to a decline in market crack spreads that reduced realized refining margins. Revenue declined 28% to $35.090 billion, but topped the consensus forecast of $32.126 billion.

The Refining segment’s 2Q23 adjusted pretax income was $1.134 billion, compared to $3.096 billion a year earlier. The decrease was due to a decline in margins, partly offset by higher volumes and lower operating expenses.

Realized margins decreased due primarily to the decline in market crack spreads and lower feedstock advantage. Pretax turnaround costs were $102 million. The company’s worldwide crude utilization rate was 93%, up from 89% in the prior-year quarter.

The Chemical business consists of Phillips 66’s equity investment in Chevron Phillips Chemical (CP Chem). Adjusted pretax income fell to $192 million in 2Q23 from $273 million in 2Q22. The decrease reflected lower margins and volumes, partly offset by lower utility and feedstock costs. Global olefins and polyolefins (O&P) utilization was 98%.

The Midstream division recorded 2Q23 adjusted pretax income of $604 million, up from $258 million in 2Q22. The improvement was driven by higher fractionation volumes in the NGL business, despite lower NGL commodity pricing and stronger Transportation earnings. Additionally, the division benefited from the recent buy-in of DCP Midstream.

In the Marketing & Specialties business, adjusted pretax income declined to $644 million from $739 million in 2Q22, largely due to lower global marketing margins on lower realized commodity prices.

Recommended Action: Buy PSX