Pan American Silver (PAAS) missed its earnings estimates for the second quarter, but production came in at the high end of guidance, while costs for both gold and silver were lower than estimates. This bodes well for a strong close to the year as the additional costs of the Yamana acquisition fall off, maintains Adrian Day, editor of Global Analyst.

The company had guided that the second half of the year would be stronger than the first, with sequential production growth and lower costs, and the company maintained its guidance. The significant development this past quarter is that Pan American has consummated several asset sales, as promised when it acquired Yamana, with proceeds of $593 million.

Most notable was its interest in Mara, sold for $475 million; it also sold its shares in junior companies. Pan American has always emphasized a strong balance sheet, and these sales are intended to improve its financial position following the Yamana acquisition.

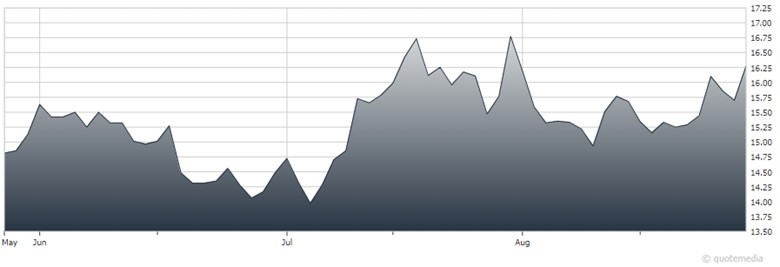

Pan American Silver (PAAS)

The sales of non-core assets also streamline the company’s asset portfolio. Most of the mine interests sold were in smaller mines or ones approaching the end of their lives. The company kept royalty interests in the projects it sold in order to maintain upside in the projects. The sale of several mines and mine interests only months after the closing of the Yamana acquisition is quite an accomplishment.

More sales are to come. CEO Michael Steinmann said the company had not finished its asset sales yet, noting that (unlike most gold miners these days) it was not interested in copper. It may sell some copper assets and keep a royalty to maintain the upside in projects.

It has not decided what to do with its growing portfolio of royalties, but noted its previous successful spin-off of prior royalties into Maverix, subsequently acquired by Triple Flag. The cash raised will eliminate over half of the debt acquired in connection with the Yamana purchase, putting Pan American on track to be, once again, cash positive on its balance sheet next year.

At the end of Q2, Pan American had $409 million in cash and $1.1 billion in debt. The company also announced its annual reserve and resource update. Resources at the legacy Pan American assets declined by about 10%, through depletion, emphasizing again the importance of the Yamana acquisition.

Pan American is valued significantly below the valuation of other silver miners (though the market increasingly looks at it as a gold and silver miner), and below other gold miners. With the strong balance sheet, deep portfolio, and upside from Escobal, Pan American is a buy.

Recommended Action: Buy PAAS.