Earnings season is now largely completed, and, as usual, it turned out much better than Wall Street expected. S&P 500 earnings from continuing operations fell 3.4% year-over-year from 2Q22 -- much better than the preliminary forecast for a 6%-7% decline. Excluding the Energy sector, earnings actually rose 3% YOY, explains John Eade, president of Argus Research.

Earnings exceeded expectations as they usually do: Almost four-fifths of S&P 500 companies reported earnings above expectations, compared to the long-term average of 66%. And the “beat” was above normal. Companies tended to exceed pre-reporting estimates in 2Q by about 8%, compared to the average surprise factor of 4.1%.

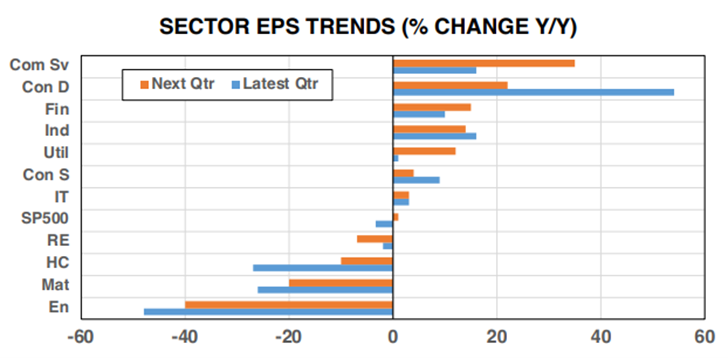

By sector, the strongest earnings growth came from Consumer Discretionary, Communication Services, and Industrials. Lagging sectors were Energy, Materials, and Healthcare. The all-important Technology sector reported a 3% increase in EPS.

Some sector trends are starting to emerge. Energy, which was the strongest EPS contributor in 2022, is facing difficult comparisons as oil prices have slumped; sector earnings are expected to decline 40% in 3Q. Materials are no longer benefiting from peak commodity prices and EPS for the group are expected to decline 20% next quarter.

On the brighter side, Communication Services earnings are expected to ramp higher, generating a 35% gain in 3Q compared to the 16% advance in the recently completed 2Q. Overall, the 2Q EPS decline followed EPS declines in 4Q22 and 1Q23 and thus constituted an “earnings recession.” At this point, 3Q S&P 500 EPS are expected to rise 1% and then continue to grow into 2024.