Income investors looking for high-yield stocks with growth potential should consider investing in real estate investment trusts, or REITs for short. The appeal of REITs is straightforward: REITs allow anyone the opportunity to profit from real estate properties, without actually having to own property. Realty Income (O) is one to consider, notes Bob Ciura, contributing editor at Sure Dividend.

REITs operate across a number of sectors, including industrial, healthcare, and retail. REITs are required to distribute the vast majority of their taxable income to shareholders in exchange for a favorable tax status. As a result, investors can find high dividend yields across the REIT universe. In this way, real estate can be accessible to stock market investors as a way to generate passive income for retirement.

In addition, investors should focus on REITs with quality business models and sustainable dividend payouts. Realty Income is a retail-focused REIT that owns more than 4,000 properties. It owns retail properties that are not part of a wider retail development (such as a mall) but instead are standalone properties. This means that the properties are viable for many different tenants, including government services, healthcare services, and entertainment.

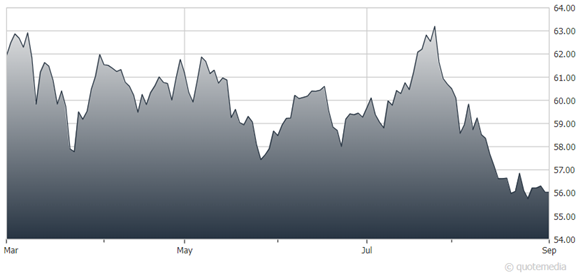

Realty Income (O)

In the 2023 first quarter, the company’s net income available to common stockholders was $225 million, equivalent to 34 cents per share. Normalized funds from operations (FFO) per share increased by 2% to $1.04 compared to the same period last year. Adjusted funds from operations available to common stockholders was $650.7 million, or 98 cents per share.

Realty Income generates its growth through growing rents at existing locations, via contracted rent increases, or by leasing properties to new tenants at higher rates, as well as by acquiring new properties. In the first quarter, the company invested $1.7 billion in 339 properties and properties under development or expansion. The initial weighted average cash lease yield for these investments was 7%.

The company also expects to increase its investments in international markets during the next couple of years. Indeed, it made a first deal in the UK in 2019 and plans to do more such deals in the future when it finds attractive targets. These acquisitions will help drive profits in the long run.

Realty Income is well-known for its monthly dividend payments. Indeed, the company has now declared consecutive monthly dividends for over 50 years. Realty Income has also increased its dividend for over 25 consecutive years, placing it on the exclusive list of Dividend Aristocrats. In fact, Realty Income is only one of three REITs on the Dividend Aristocrats list. Shares recently yielded 5.4%.

Recommended Action: Buy O.