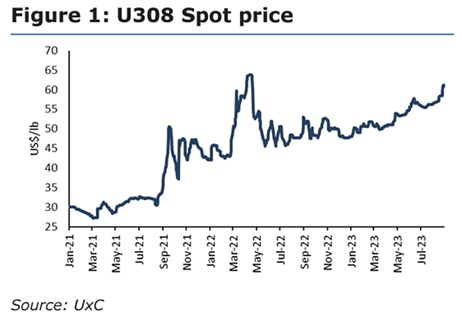

While all other metals slog along, uranium is stepping forward. After a few quiet months, the spot price started picking up recently, besting US$60 per pound for the first time since 2011 other than that spike last spring. I am happy with my uranium exposure, including NexGen Energy (NXE), writes Gwen Preston, editor of Resource Maven.

Notably, the price made this 10% move with almost no financial buying – it was real users, not stockpilers like the Sprott Physical Uranium Trust (U.UN.CA), buying pounds no matter the impact on price.

That begs the question of what will happen when financial buyers move back into the market. SPUT and the other big stockpiler, Yellowcake, can only issue new units when they are trading at a premium to their net asset values (NAV). Premiums happen when investors want exposure to uranium – their buying pushes SPUT’s market capitalization above the value of its uranium stockpile.

For SPUT that hadn’t happened since February, which means SPUT has not been driving the uranium market for months. That SPUT’s valuation is catching up with a rising spot price shows that investors are paying attention to that rising spot. As they should.

Every uranium analyst I read describes the market as “coiled” or “ready to bolt” or something similar. And while bullish uranium investors might say things like that out of hope, analysts generally base their comments in reality.

This is a tight market. Cameco (CCJ) reducing its 2023 production forecast because of challenges at Cigar Lake didn’t help. It's also tight on the contracting front, where activity was high in Q1 before easing through the middle of the year. And I mean ‘high’ – 121 million lbs. were contracted in the early part of the year, compared to 125 million lbs. in all of 2022.

US utilities were notably absent in this year’s contracting spree; contracting volumes could well ramp up toward the end of the year as they catch up.

As for NXE, it recently announced a term sheet to raise US$110 million in debt, specifically debentures that can at the holders’ option be converted to shares at C$9.15 apiece, which is notable as a premium to NXE’s current trading price.

It underlines that the two groups providing this capital (Queen’s Road Capital and Washington H Soul Pattison) really believe in this asset. The deal will give NexGen about $230 million on hand to fund early construction works.

Soon, NXE should be ready to roll right into ordering long lead-time items and starting the build. The company will have to arrange another, much larger finance package to build this mine but this early debt deal puts them in a good position to keep momentum.

Recommended Action: Buy NXE.