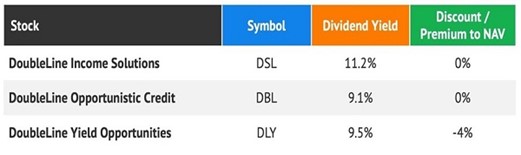

I recently talked about maraschinos in a dividend column because we finally have some bond funds worth cherry picking. Let’s look at three funds below. They are all run by the same fixed-income deity. One – the DoubleLine Yield Opportunities (DLY) – is ridiculously cheap, opines Brett Owens, editor of Contrarian Income Report.

DLY wins the maraschino cherry award for this month. It’s run by the “Bond God” Jeffrey Gundlach and his crew, yields 9.5%, and trades at a 4% discount to its net asset value (NAV). A cherry indeed!

Here’s how that works. The bonds that DoubleLine owns in DLY add up to an NAV of $15.29. But as I recently wrote, the fund traded around $14.67 per share. This means we had a 4% discount window. If and when this deal ends, as it has for DLY’s two sister funds, it will bring price gains for us.

Riding with the Bond God for 96 cents on the dollar is a sweet deal. But there’s more. DLY employs only 20% leverage, which is on the lower end for a closed-end bond fund.

That’s important now because the Federal Reserve (as you may have heard) is considering yet another rate increase. That boosts the cost of capital for closed-end funds like DLY. Yes, a creditworthy outfit like DoubleLine gets to borrow more cheaply, but its costs are still ultimately tied to short-term rates.

Same goes for a firm like PIMCO. The California fixed-income powerhouse gets sweet deals, but connections and credibility only go so far. As short-term rates continue to rise, borrowing costs PIMCO more.

Which is why we’ve been anti-leverage lately. We want bond funds that are less susceptible to rising short-term rates.

Discount deals like the one with DLY are unique to CEFs. Unlike their mutual fund and ETF cousins, CEFs have fixed pools of shares. Which means they can trade at premiums and discounts to their NAVs.

So why pay a premium? It’s not needed when we have cherries like DLY trading for 96 cents on the dollar!

Brett, why not DSL—it pays 11.2%?! I realize some readers never made it past the biggest yield in the DoubleLine aisle. Yes, DSL pays 11.2%. It levers up a bit more than DLY to do it (24% versus 20%). That’s all right, but in this fickle financial world, give me the bigger discount.

After all, they are run by the same people! The disparity in valuations doesn’t make much sense. We’ll gladly take advantage.

It’s been a rough 36 months in the bond market, but bargains are starting to pop up. We’ll grab them as they become available starting with the maraschino dividends.

Recommended Action: Buy DLY.