If you’re wondering what is driving the stock market’s behavior these days, it really boils down to one thing: Interest rates. But you can use higher interest rates to your advantage. And one of the best ways to do that is to buy bonds via a vehicle like the iShares 7-10 Year Treasury Bond ETF (IEF), counsels Jim Pearce, editor of Personal Finance.

Since hitting an all-time high near the end of 2021, the S&P 500 Index has failed to sustain a rally strong enough to break through to new highs. Its steady decline starting in early 2022 was simultaneous to the Fed’s decision to start raising interest rates at that time.

Over the same span, the price of crude oil has also fallen. Despite its recent rise above $90 a barrel, oil prices are still considerably lower now than they were a year ago. Also, the price of gold has traded in a narrow range over the past three years but is below its all-time high price from three years ago.

However, the yield on the 10-year Treasury note has soared over the past three years and is at its highest level in more than fifteen years. That was shortly before the stock market crash of 2008/2009, when the S&P 500 Index lost half its value in less than a year.

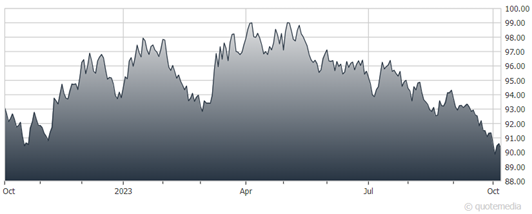

iShares 7-10 Year Treasury Bond ETF (IEF)

I don’t say that to frighten you, but to make a point. What we are going through now is nothing compared to that. That is also why the Fed is taking a hawkish stance towards monetary policy, since it does not want a repeat of what happened then.

According to the current “dot plot” of the Fed’s expectations for monetary policy, it will not be until 2025 that we start to see a meaningful reduction in interest rates. After that, the Fed’s policy rate is projected to drop in half by the end of 2026. That is three years from now, so we are going to have to get used to living with higher interest rates for a while.

In the meantime, there are two advantages to buying bonds while interest rates are high. Not only do they pay out more in current income, but they should also appreciate when interest rates start coming down. The net result can be a total return that equals or exceeds the long-term average return on stocks.

Since peaking above $123 a share three years ago, IEF fell below $92 recently. If it makes it back to $123 over the next three years, that equates to a 27% gain plus the dividends paid along the way.

That may not sound too exciting. But bear in mind that the average annual return of the S&P 500 Index over the past thirty years is roughly 10%. And if the Fed has its way, we may be lucky to do that well until interest rates are low again.

Recommended Action: Buy IEF.