September was another rough month for stocks overall and an especially brutal month for regional banking and utility stocks. But once the fever breaks, interest rates will finally level off and perhaps even tick down a bit, and stocks will also start to find their footing again. I like Runway Growth Finance Corp. (RWAY) here, writes Nate Pile, editor of The Little River Investment Guide.

Rising rates have been causing investors to flee the regional banking sector because the speed at which rates have risen has put many smaller banks in a tough position from an operations standpoint. But I think all of the Silicon Valley Bank-type problems have already been "sniffed out" by the market. So I am not terribly worried that there will be more implosions in that sector – just a lot of limping along until things start to normalize.

Plus, the manner in which stocks and interest rates have been acting lately...coupled with the fact that important lows for the stock market are often made in October for a variety of reasons...suggest to me there is a reasonable chance that “the madness of crowds” will finally reach its climax sometime between now and the end of the year.

As for RWAY, it is a business development company (BDC) located in Silicon Valley. It specializes in making investments in senior-secured loans (usually in the $10-$75 million range) to late stage and growth companies.

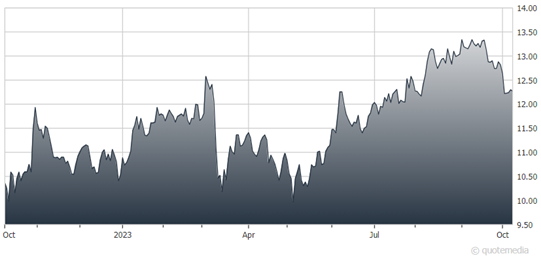

Runway Growth Finance (RWAY)

Given that it is located in Silicon Valley, it should come as no surprise that it makes its loans to companies associated with “anything and everything Silicon Valley,” from high tech to biotech to online retail sales. There is currently a great deal of concern among investors that companies in these sorts of industries will struggle if the economy does take a turn for the worse.

But I think it is important to keep in mind that the data currently does not suggest a steep downturn is taking place. Even if we do get a slowdown, it does not necessarily mean that loans will not be repaid. And, of course, we have to assume that the folks at Runway are being proactive about managing their risk when they make their investments.

To capture the nice dividend yield being paid on the stock (recently 14.6%), as well as gain more exposure to an industry that is doing well in the current interest rate environment, RWAY is a buy under $14.

Recommended Action: Buy RWAY.