Focus on quality. Invest incrementally. Keep a generous pile of cash to scoop up bargains when prices become too low to resist. That’s been our basic strategy in 2023, in anticipation of worse to come for the economy and markets. And tough times are exactly what we’ve seen recently in utility stocks. But for the conservative investor, I still like long-time holding Duke Energy (DUK), advises Roger Conrad, editor of Conrad’s Utility Investor.

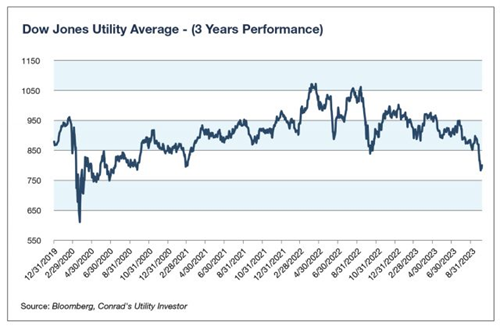

For the 10th time in the post-World War II period, the S&P Utilities Index has dropped by more than 20 percent from its previous all-time high – reached in September 2022. I recently highlighted key headwinds facing utilities and essential service stocks this year – and reasons why I didn’t think we’d seen the worst of this more-than-year-old downturn.

Unfortunately, those headwinds reached hurricane force in September and October. If you exclude the pandemic-spurred Flash Crash of February/March 2020, you’d need to go back to the 2008 Financial Crisis to find a worse few weeks, and before that, the late-2001 Enron implosion.

If you invest in stocks long enough, you learn the sun always rises and it’s always darkest before the dawn. So long as the companies you own stay strong as businesses, recoveries from downturns of -20 percent or more are typically breathtaking.

That’s one reason why I still have a handful of solid fresh money buys, including DUK.

Earlier this month, Duke Energy closed the sale of its commercial distributed generation unit to a private capital consortium for $364 million. And later this year, it will complete the sale of its utility scale renewable energy unit to Brookfield Renewable Partners (BEP) for $2.8 billion.

Those proceeds add up to meaningful debt reduction with a minimal impact on earnings. And they focus Duke squarely on its core regulated utility business, with 8.2 million electricity customers in six states (90 percent revenue) and 1.6 million gas customers in five (10 percent).

Duke has $73.8 billion of total borrowings, including $24.8 billion on the parent level. And during the Q2 earnings call, management stated it has $130 billion in regulated utility CAPEX over the next 10 years—including $65 billion largely approved for the next five. That adds up to a major appetite for capital.

But it’s reliable fuel for guidance annual earnings growth of 5 to 7 percent through 2027. And it’s backed by solid regulatory support, starting with North Carolina where the company now enjoys performance-based rates. Other key states include Florida, Indiana, and South Carolina, among the most favorable regulatory environments in the US.

Recommended Action: Buy DUK.