Markets are facing a 5% dilemma. The benchmark Treasury yield closed just above 4.9% recently, a fresh 16-year high. The market will likely turn broadly positive when expectations are that interest rate hikes are over – and lower rates may be around the corner. In the meantime, I still like Tesla (TSLA), which reported a good third quarter, outlines Carl Delfeld, editor of Cabot Explorer.

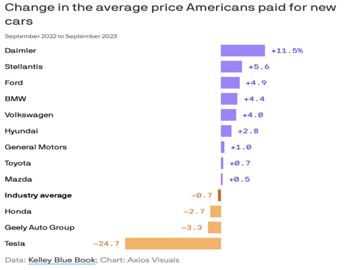

While profits were down in the quarter compared to a year earlier, it was still a solid showing given the multiple price cuts across the company’s lineup (see graphic, courtesy of Kelley Blue Book). Tesla also revealed that Cybertruck deliveries are on track to begin next month.

While profits were down in the quarter compared to a year earlier, it was still a solid showing given the multiple price cuts across the company’s lineup (see graphic, courtesy of Kelley Blue Book). Tesla also revealed that Cybertruck deliveries are on track to begin next month.

For the quarter, total revenue was up 13% at $23.4 billion with reported adjusted earnings per share (EPS) of $0.66, nearly 30% lower than a year ago.

Tesla believes it will meet its 2023 production goal of 1.8 million vehicles. Through three quarters of the year, Tesla has delivered around 1.3 million vehicles globally, so the company will need a very strong quarter to hit its annual delivery goal.

The company also said it expects Model Y production to gradually ramp up higher at Giga Austin and Giga Berlin.

Recommended Action: Buy TSLA.