Exxon Mobil (XOM) is among the world’s largest oil and gas providers and integrated refiners and marketers of petroleum products. XOM’s conservative risk profile throughout varying business cycles and its extensive portfolio of resources has enabled it to maintain strong debt ratings, explains Marty Fridson, editor of Forbes/Fridson Income Securities.

We initially recommended XOM’s common shares as a Buy for low- to medium-risk taxable portfolios in August 2020, reaffirming our Buy recommendation as part of a corporate update in June 2022. We also raised the fair value price to $115 from $55.

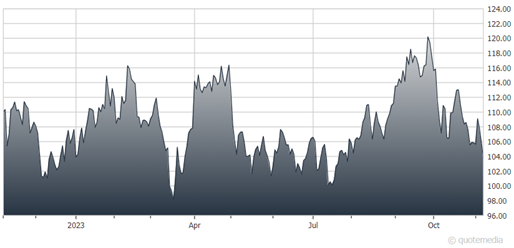

Exxon Mobil (XOM)

XOM has continued to maintain very strong earnings, liquidity, and capital measures, especially over the last three years, driven by improved energy demand and sharply higher prices for energy products. On Oct. 11, the company announced an all-stock merger with Pioneer Natural Resources (PXD) for $59.5 billion.

PXD is a Texas-based energy company, engaged in hydrocarbon exploration in the Cline Shale, located in the Permian Basin. Under the terms of a definitive agreement, PXD shareholders will receive 2.3234 common shares of XOM for each PXD share.

The transaction is expected to close in the first half of 2024, subject to regulatory and shareholder approval. As part of this transaction, XOM will look to leverage its Permian greenhouse gas reduction plans and accelerate PXD’s net zero emissions plan by 15 years to 2035. The merger gives the combined companies an estimated 16 billion barrels of oil-equivalent resources in the Permian Basin.

Both Moody’s and S&P view the transaction positively, as PXD will significantly boost XOM’s Permian position. We expect this merger to close successfully. As a result, we continue to recommend XOM’s common shares as a Buy for low- to medium-risk taxable portfolios. Dividends are qualified and taxed at the 15%-20% rate.

Recommended Action: Buy XOM.