Bond and equity prices surged after the October Consumer Price Index (CPI) data came in better than consensus. The shelter component, Owner’s Equivalent Rent, which makes up 35% of the overall index, was up 0.4% on a monthly basis and below the average forecast of +0.6%. I like Flex LNG Ltd. (FLNG) here after it reported another excellent quarter, notes Bryan Perry, editor of Cash Machine.

Vessel operating revenues were $94.6 million for the third quarter 2023, compared to $86.7 million for the second quarter 2023. Net income was $45.1 million and basic earnings per share (EPS) were $0.84 for the third quarter 2023, compared to net income of $39.0 million and basic earnings per share of $0.73 for the second quarter 2023.

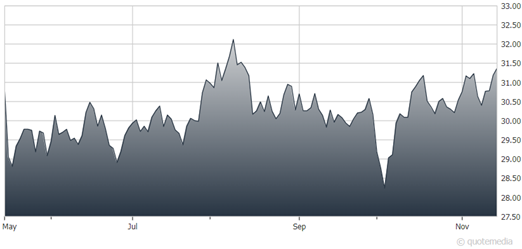

Flex LNG (FLNG)

The average TCE rate was $79,207 per day for the third quarter 2023, compared to $77,218 per day for the second quarter 2023. Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) were $74.7 million for the third quarter 2023, compared to $66.2 million for the second quarter 2023.

Adjusted net income was $36.1 million for the third quarter 2023, compared to $28.2 million for the second quarter 2023. Adjusted basic earnings per share were $0.67 for the third quarter 2023, compared to $0.53 for the second quarter 2023.

The company declared a dividend for the third quarter 2023 of $0.875 per share, consisting of a quarterly dividend of $0.75 per share and a special dividend of $0.125 per share. The ex-dividend is Nov. 27, payable on Dec. 5.

Recommended Action: Buy FLNG.