Stocks RIPPED higher, Bonds RIPPED higher, and investor excitement RIPPED higher after the government told us that inflation is cooling. So, what happens next? Here’s what I’m watching, explains Kenny Polcari, chief market strategist at SlateStone Wealth.

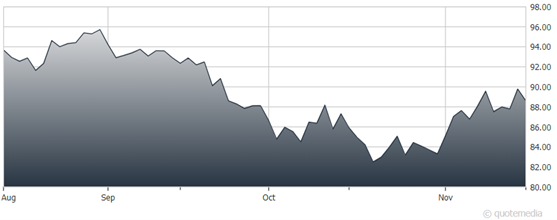

The iShares 20+ Year Treasury Bond ETF (TLT) rose by 2.3% and the iShares 10-20 Year Treasury Bond ETF (TLH) gained 2% in the wake of the inflation news. Of the broad 11 S&P sector ETFs, the Real Estate Select Sector SPDR Fund (XLRE) was the clear winner, rising by 5.4% in one day. That left all three down on the year, but well off the lows we saw one month ago.

Utilities – which have also been under pressure at the prospect of ongoing rate hikes – were also a leader. The Utilities Select Sector SPDR ETF (XLU), which is the very definition of boring, rose 4%!

The line has been drawn in the sand. The December FOMC meeting will see another pause. But before you throw a party, understand one thing: Easing bond yields result in “looser financial conditions,” which is counter to what the FED wants.

iShares 20+ Year Treasury Bond ETF (TLT)

Chairman Jay Powell wants to hold rates higher for longer (remain restrictive) in order to convince us that they killed the inflation monster. But the market and investors are already planning on 2024 rate CUTS – something that “JJ” will most likely continue to fight.

The tightening that higher yields represented fades if we get a substantial bond rally that will send yields down and that only further complicates JJ’s job. Lower yields are stimulative, creating demand. And then you know what’s next. The inflation monster is reborn and it’s off to the races.

So, while I do agree that we are in pause mode now, I remain in the camp that the Fed is not cutting rates as the market expects. But that’s me. You do you.

Now – again, I would say – that that is not a reason to not be in the market. Remember, it is TIME IN the market, not TIMING the market, that counts. Which is why I say talk to your advisor, build you plan, and then stick to it.

Tweak as necessary. But make sure you have a core foundation of large/mega cap names in the industries you are in. Look. I love to see the market go higher, and I would love to see us avoid a recession. While I am not convinced that is going to happen, the market should continue to enjoy higher prices as it digests the fact that we are most likely at the peak for yields. And even if we stay here, the market can advance. Remember: 4%-6% rates are NORMAL. Anything substantially below or above is abnormal.

Finally, many are asking “Did Santa come early”? Can we keep going higher from here? The S&P is up 10% in two weeks, leaving it up 17% year-to-date. That’s a fine performance by most measures. We are 100 points away from the 2023 highs of 4,600. That’s essentially 2.5%.

Can we do it? Of course. But in any event, don’t go chasing names you already own on “up” days. Sit back, do your homework, and then move appropriately.