I have this new 20-minute window in my life each day. My kid started pre-school this fall. Each morning, we take a 15-minute ride on public transit to drop him off. On the way back, I have about 20 minutes of waiting for and riding the bus home. So, with this new window of quiet reflection, I did the most cliché thing an investor could do: I started re-reading The Intelligent Investor (the 2003 edition with commentary from Jason Zweig), recounts Tyler Crowe, author of Misfit Alpha.

I didn’t think I would ever pick the book back up, to be honest. As I’ve said before, my first read a decade ago made me seriously question its relevance (what fantasy land produced 8% yield on AAA-rated corporate bonds?).

But after reflecting on where we stand in the markets today and contemplating the idea of investing for many years in a high or rising interest rate environment, I decided to pick the book up again.

We spent 40 years in a declining interest rate environment. Outside of Buffett & Munger, there aren’t many investors left with experience in these financial conditions. I thought a re-read could unearth some new tidbits that I had either long forgotten, dismissed as something long since gone, or missed entirely on the first pass.

It only took a few pages before I started rushing for my notebook. One of the book's delights isn’t Graham; it’s reading Zweig’s commentary at the end of each chapter. He helps to bring forward investing lessons from 30 years prior and uses examples that some of us can relate to much more than a book first written before most of us were born.

One note that stood out to me was Zweig’s commentary on the chapter about the relationship between investing and inflation. In it, Zweig made note of “new financial products” that were invented after Graham had hung it up: REITs (Real Estate Investment Trusts) and TIPS (Treasury Inflation-Protected Securities).

The theory presented was that both products are better designed to protect one’s wealth in inflationary periods than stocks or bonds (assuming that inflationary periods bring about rising interest rates and lower bond values).

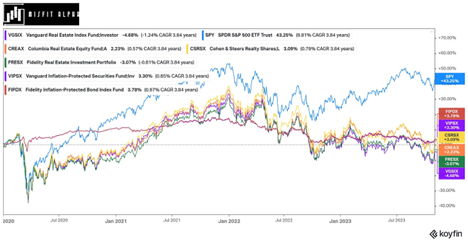

Yet the post-pandemic inflation surge and subsequent federal funds rate increases have tested the inflation-protection bona fides of funds that invest in those assets. In a period where inflation surged as high as 9.06% and the Federal Funds rate has ratcheted up to 5.33%, several category funds lost ground to inflation. A couple of them have posted negative returns since January of 2020. (Note: Cumulative inflation since January of 2020 is 18.92%).

I’m not pointing this out because I think Zweig was wrong 20 years ago. This is probably too short of a time to say this inflation-protection strategy doesn’t hold up. But these funds designed to beat inflation have struggled to do so when inflation moved far outside the 20-year historical range. Perhaps these funds will return to their respective inflation-beating ways.

That said, any investor looking to protect their wealth from inflation before the Covid-19 pandemic and took Zweig’s pointers has been disappointed. And I do wonder, based on the material changes to the REIT industry and the explosion of lower-cost ETFs in the past 20 years, if Zweig would give the same recommendation he did in 2003.