Investment markets bounced sharply higher in early November, reversing trends and relative returns in different investments. I don’t expect the new trend to be sustained – and that’s why I still recommend the Hussman Strategic Growth Fund (HSGFX), counsels Bob Carlson, editor of Retirement Watch.

HSGFX has been struggling since the market bottom in October 2022. But if my assessment of the markets and economy is accurate, market hedges contained in funds like HSGFX will benefit our portfolios in 2024 as they did in 2022.

HSGFX owns about 280 stocks that were selected because they sold at discounts to their growth rates. Manager John Hussman practices risk management. He uses futures contracts to leverage the stocks when market conditions are favorable or to hedge them when conditions are unfavorable.

Two factors are used to determine these positions. Market valuations give a long-term assessment of the markets. An assessment of the shorter term is made using a large collection of market trend data that Hussman calls market internals.

In recent years, market valuations generally have been near record highs while market internals indicated investors are more risk averse than speculative. Both conditions are negative for stocks. In response, the fund has been hedged against a market decline most of the time.

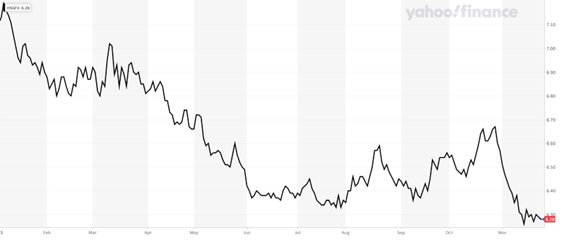

Hussman Strategic Growth Fund (HSGFX)

The positioning helped through most of 2022, but hurt returns in 2023. The fund was recently down 2.7% in four weeks, 2.3% over three months, 10.8% for the year to date, and 8% for the last 12 months.

But even as the economy is growing at a solid rate despite the fastest tightening of monetary policy in 40 years. I don’t expect the growth rate to continue. Plus, in 2024, stock prices will have more headwinds than they had in 2023.

Higher interest rates will reduce cash flow as businesses roll over debt. The tight labor market and the higher wages that come with it will continue to crimp profit margins and then stock prices. Because of the sticky inflation of the last two years, businesses are paying higher prices for most inputs in addition to labor.

Reduced globalization decreases sales as well as opportunities to contain costs through outsourcing. Government policies throughout the world are less favorable to businesses than they’ve been in decades. And businesses face additional costs imposed by efforts to respond to climate change.

These headwinds, plus high stock valuations, make it unlikely the indexes are on the verge of a sustained return to record price levels. I don’t expect stocks to crash. It is more likely that prices will stall and gradually fall.

Recommended Action: Buy HSGFX.