I’ve talked a lot about interest rates in the last while. I had to because they were THE reason gold moved decisively up through $2,000 per ounce and rate expectations are THE factor that will determine where gold goes from here. So the recent Federal Reserve meeting was a big one for precious metals, explains Gwen Preston, editor of Resource Maven.

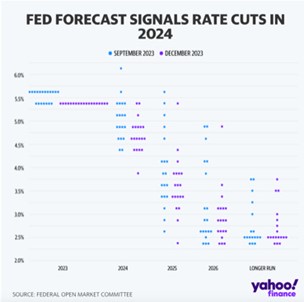

Look at the Fed’s “Dot Plot” for 2024. The blue dots show that, in September, Fed officials expected to make one, or maybe two, rate cuts next year. Now, they expect to cut three, perhaps four, times in 2024.

Three cuts to get to a Federal funds rate of 4.5%-4.75% is a different outlook than one cut to get to 5%-5.25%. Importantly, it justifies the sharp drop in yields that we just experienced. They dropped more than three rate cuts worth, but confirmation that the Fed not only expects to cut next year but expects to cut several times supports the concept of positioning for a declining rates environment.

Now, I don’t really think the market’s more aggressive rate hike forecast than the Fed’s is actually because a significant chunk of traders think there will be a recession in 2024. I think it’s the combination of...

- The huge change in setting and mentality, from rates running higher to rates falling, and

- Awareness that a recession is possible

That has investors positioning for cuts more aggressively than is logically justified. But expecting rates to change sooner is what the market always does. And this matters because the biggest risk for gold over the next few months is the market stepping back its rate cut expectations.

Gold rises when rates fall. That is what propelled the yellow metal up through $2,000 per oz. two weeks ago. And it is why gold, after sliding back below that round number recently when strong jobs data put cuts into question, burst back up through $2,000 when the Dot Plot confirmed that the Fed plans to cut.

If the market were to decide it had, in fact, significantly overestimated rate cuts next year, yields would rise and push down on gold. But this Dot Plot put that fear to bed for a while, which is a lovely way to head into the Christmas holidays!