I’m going to talk about Southeast Asia and revisit a previous 10X pick that has come back to earth, giving us an excellent price entry point to capture growth in the region. The company: Sea Limited (SE), highlights Carl Delfeld, editor of Cabot Explorer.

Sea has three core businesses: 1) Digital gaming/entertainment, 2) E-commerce, and 3) Digital payments and financial services, known as Garena, Shopee, and SeaMoney, respectively.

Garena is a leading global online games developer and publisher. Shopee is the largest e-commerce platform in Southeast Asia and Taiwan. SeaMoney is a leading digital payments and financial services provider in Southeast Asia.

Sea Limited (SE)

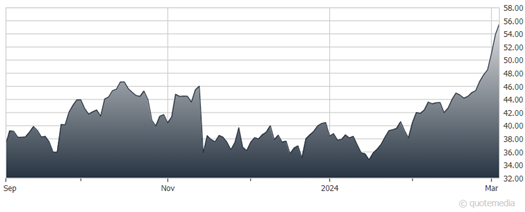

Some of you may recall this stock, which was an Explorer recommendation in the fall of 2019 at around $30 and became more than a 10-bagger to its 2021 high. During its rise, I suggested several times for members to take partial profits. So, if they followed this advice, their profits were less than 10X – but who’s complaining?

The stock eventually came back to earth primarily because its explosive revenue growth slowed a bit and expenses also kept rising. Losses were persistent and large. But the stock has retreated nearly 90% from that peak even though Sea’s management finally got control of its expenses. And though revenue has continued to grow, albeit slower than before, management made good on its promise to show some profits through cost-cutting and efficiency measures.

A key challenge now is Sea’s gaming arm, Garena. Its big hit game Free Fire led this segment to prominence and fueled the company’s stock surge, but now it needs a sequel. However, offsetting this decline is profits in both its Shopee e-commerce segment and its SeaMoney fintech segment. If the gaming group can return to growth and profits, Sea’s stock has the potential to regain its momentum.

Now that the company has achieved profitability and has a strong balance sheet and sizable cash balances, it can also spend to accelerate growth across all three segments. Sea was profitable in the first and second quarters of 2023, but last quarter, on revenue growth of 5%, it reported a loss of $144 million.

Recommended Action: Buy SE.