I am looking at the opportunity that comes from investing in tax-free bond closed-end funds (CEFs). Most people do not understand that taxes are going up before too long. It is inevitable given the mismanagement of the federal budget and balance sheet. One attractive CEF is the Nuveen AMT-Free Quality Municipal Income Fund (NEA), counsels Tim Melvin, editor of Underground Income.

As a country, we have been borrowing money almost continuously for the last 50 years to pay for politicians’ promises and programs. That is not a political opinion. It is a mathematical fact.

In the past, when discounts on tax-free, closed-end funds neared current levels, it was a buying opportunity leading to outsized profits. It will be this time as well.

Nuveen AMT-Free Quality Municipal Income Fund (NEA)

NEA invests in high-quality bonds not subject to the Alternative Minimum Tax (AMT). That is a special tax that the government likes to collect if you are too good at avoiding taxes. I will spare you a lengthy explanation. If you are subject to it, you know what it is. If you are not, it does not matter.

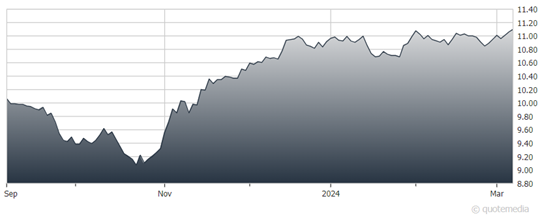

The fund recently traded at a 14.7% discount to net asset value and had a distribution yield of 4.6% free of federal income taxes. This is the equivalent of a 7.6 % taxable yield.

Several leading activists and CEF specialists own the fund. The largest holdings in the fund are supporting dormitories at universities in New York, bringing water to Las Vegas, maintaining and expanding a turnpike in Texas, and building a hospital in Colorado.

The fund invests in lingering maturities, so it should appreciate dramatically during a rate-cut cycle from the Federal Reserve.

Recommended Action: Buy NEA