I have adopted many of the principles of one of the greatest figures to emerge from the history of Wall Street, Bernard Baruch, in the approach I use here at the Takeover Letter. The most significant adaptation is a stoic, numbers-based approach that relies heavily on the math of credit analysis and corporate valuation. One name I like is Oil States International Inc. (OIS), notes Tim Melvin, editor of Takeover Letter.

I have no interest in short-term uniform speculation and only care about short-term price movements when they give us a chance to buy quality at a bargain price. I go to great lengths to use numbers to remove bias and emotion from the analysis and investing process. Like Baruch, I use the same math and reason when evaluating companies that potential purchasers use, such as larger competitors and private equity firms.

Regarding OIS, hopefully the addition of another energy stock is not a big surprise. We continue to see robust mergers and acquisitions activity across the energy patch, and this should be another big year for oil and gas takeover activity.

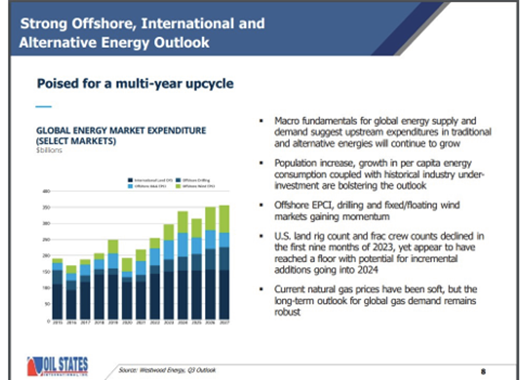

OIS is an oil services company exposed to onshore fracking and drilling operations, offshore drilling, and alternative energy. The continued global population growth will drive higher energy demand, leading to a long runway for the demand growth for Oil States International’s services.

Oil States International is active in all the major US shale fields for oil and gas. The company is also developing a deep-sea mineral mining business that could lead to quantum growth. The global demand for rare earth and critical metals to meet the demand for renewable energy and electric vehicles continues to increase.

Materials found on the ocean floor include high-demand resources, including cobalt, manganese, nickel, rare earth elements, titanium, copper, lead, lithium, platinum, and zinc. This company’s strong presence in both on and offshore drilling markets, along with the potential of the deep sea mineral business, will likely attract potential buyers as the energy industry continues to consolidate.

Finally, the business’s financials are excellent. It uses its cash flow to reward shareholders, reduce debt, and grow the company.

Recommended Action: Buy OIS.