We are raising our rating on Micron Technology Inc. (MU) to “Buy.” The stock surged in the after-market on March 20 when the company delivered fiscal 2Q24 revenue well above the high end of its guidance range. Micron posted solid non-GAAP profits against management loss guidance and consensus loss expectations, as volume leverage drove margin recovery and expansion, writes James Kelleher, senior analyst at Argus Research.

Fiscal 2Q24 revenue rose 58% annually as the company’s end market continues to recover from trough-like conditions a year earlier, and also rose 23% sequentially from fiscal 1Q24. For fiscal 3Q24, management guided for better-than-anticipated revenue of $6.6 billion, compared with the pre-reporting consensus estimate of $6 billion, and (midpoint) non-GAAP EPS of $0.45, compared with the consensus estimate of $0.20.

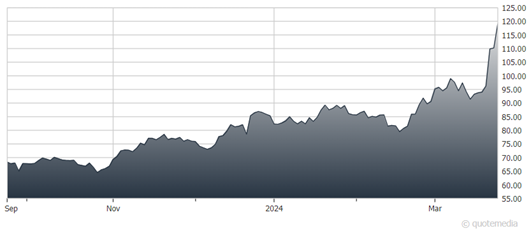

Micron Technology (MU)

Fiscal 3Q24 guidance reflects improving demand in consumer markets and demand recovery in enterprise markets. Surging AI interest is driving demand for HBM (high bandwidth memory) in the data center market. Inventories have normalized in consumer-device end markets and should finish the normalization process in data center and enterprise IT markets in coming months.

NAND and DRAM prices are now rising due to inventory normalization, the lagged effects of supply reduction, and the AI-driven demand surge in AI and cloud data centers. The company’s technology roadmap is intact in both NAND and DRAM. Favorable industry supply-demand balance, normalization of inventories, and the AI surge are all driving memory prices higher, in time for broad-based demand recovery.

After falling more than 45% in 2022, MU shares recovered in calendar 2023 and are off to a good start in FY24. We see value in MU shares in the early stage of broad-based memory demand growth. MU investors should be aware of the risks of investing in memory technology, where volatile pricing tends to drive big stock swings. Our 12-month target price is $140, and our long-term rating on MU remains BUY.

Recommended Action: Buy MU.