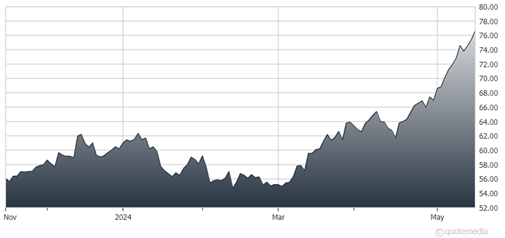

It’s been a good month in the market so far. The S&P 500 has regained all the dip from April and is now within a whisker of the all-time high. The driving forces have been an improving interest rate story and solid earnings. Plus, one of my favorite names, NextEra Energy Inc. (NEE), is now up 38% since early March, observes Tom Hutchinson, editor of Cabot Income Advisor.

With 92% of S&P 500 companies having reported Q1 profits, earnings increased an average of 5.4% over last year’s quarter. But it’s better than that. If you take out the report of Bristol-Myers Squibb Co. (BMY), average earnings growth would be 8.3% for all the other stocks on the index. That’s a strong gain.

There has also been good interest rate news. The Fed indicated that the next rate move would likely be a cut rather than a hike. That assuaged the fears of investors. Also, slower GDP and jobs growth combined with the Fedspeak to lead investors to expect the first Fed rate cut in September, with another one likely before the end of the year.

NextEra Energy Inc. (NEE)

The interest rate optimism has led to a very good month for the interest rate-sensitive stocks for a change. In fact, the best-performing S&P 500 stock sector over the past month is utilities, with a double-digit gain.

NEE features a yield of 2.8%. The combination regulated and alternative energy utility reported earnings earlier this month that slightly missed on revenues but beat significantly on earnings. The stock has continued to move higher because it was a solid report and NEE is now officially turning things around big time.

Remember: NEE had been a superstar performer before inflation and rising interest rates. It provides both safety from its best-in-class regulated utility business and growth from its considerable clean energy business.

Recommended Action: Buy NEE.