Ladies and gentlemen, start your engines! Let’s get the summer driving season underway. Summer can’t come fast enough as demand concerns linger. Even evidence of OPEC Plus compliance with production cuts, as well as signs of demand green shoots in both India and China, are not helping the oil market mood, writes Phil Flynn, senior energy analyst at PRICE Futures Group.

Petroleum markets are seemingly worried about oil inventories as the “whisper number” is suggesting that we might get a surprise increase in crude oil supplies, even as there are signs that refiners are starting to kick it into high gear. US gasoline demand has been a concern because there are fears that inflation is forcing changes in America’s driving behavior.

“Groceries or gasoline?” is the question that many Americans sadly must ask. And because we’ve only had one crude draw in the last few months, it’s raising questions as to whether crude supplies in the US are ever going to fall.

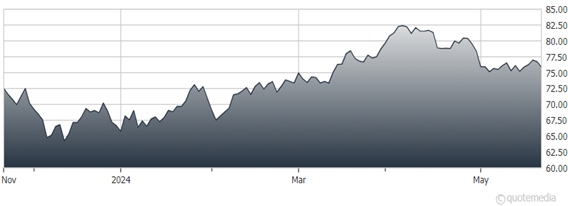

United States Oil Fund (USO)

Meanwhile, concern about the war in Gaza and its impact on oil supplies seems to have gone away. Iranian President Ebrahim Raisi’s death in a helicopter crash most likely will not change Iran’s oil production or export plans.

Reports of another Ukrainian drone attack on a small independent refinery in Krasnodar, Russia also seems to not be a big concern because Russia looks committed to reducing production and exports anyway. Vladimir Putin touted that in January through April, Russian oil production came in at 195.7 million tons – down 1.8% from the same period a year ago.

Russia continues to play hard-to-get about a commitment to extend oil production cuts into 2025. Still, Russia is widely expected to go along with the rubber-stamping of the voluntary and involuntary production cuts going into the end of 2024 at the virtual June OPEC meeting.

Saudi Arabia also is showing signs of compliance and tightening oil inventories. Saudi Arabian crude oil inventories were 139.285 million barrels in March. That was down from 145.092 million barrels in February. Saudi crude oil production fell to just 8.97 million barrels a day.

India’s oil demand continued to rise another 179,000 barrels a day from last month. OPEC projects that India’s oil demand will grow by 4% to 5.8 mbd in 2025. And a lot of that demand is going to be fed by Russian oil. India is a country that has not fallen into line with sanctions on Russian oil and has seen its imports of Russian oil increase by 40% since last year.

Bottom line: While there seems to be a rocky road for petroleum, we believe that this is an opportunity if you can get through the next couple of days depending on inventories. We think we will bottom out and start to head higher as we end the week. But in the meantime, get ready to ride the volatility.