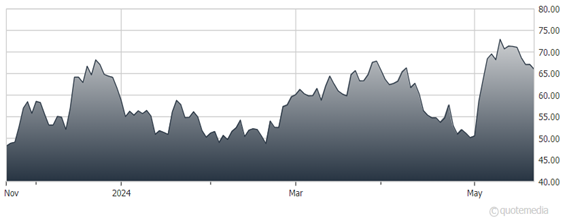

We are upgrading Wayfair Inc. (W) to “Buy” from “Hold,” with a price target of $83. Home furnishing sales began the year weak; however, growth in orders and active users − customers who have purchased at least once over the past year − should act as a catalyst for revenue, highlights John Staszak, analyst at Argus Research.

Based in Boston, Wayfair is a leading online retailer focused on furniture, housewares, and other home decor products. Its websites include Wayfair, Joss & Main, All Modern, Birch Lane, and Period. The company’s primary market is the US, though it also has operations in Canada and Europe.

Given its broad selection of furniture, home goods, and housewares, we expect Wayfair to benefit from growth in online purchases of home furnishings. Our long-term rating is also Buy.

Wayfair Inc. (W)

Wayfair reported 1Q24 results on May 4. Net revenue fell 160 basis points to $2.73 billion, but topped the consensus estimate of $2.64 billion. Active customers rose 2.8% year-over-year, to 22.3 million, and orders per customer rose. The increase in active customers was driven by judicious pricing, plus better delivery and product availability.

The gross profit was $819 million, or 30% of revenue, within management’s guidance range of 30%-31% and up from approximately 29.6% in the prior-year period. The improvement was driven by a 1.7% decline in COGS. The consensus estimate had called for a gross margin of 30.6%.

Wayfair reported adjusted EBITDA of $75 million, reversing a loss of $14 million in the prior-year period. The consensus estimate was $73.3 million. The adjusted EBITDA margin was 2.75%, reversing a 50 basis-point decline.

Below the line, interest expense fell to $235 million from $347 million, and the share count increased to 120 million from 110 million. The 1Q24 GAAP net loss was $174 million, or $2.06 per share, compared to a loss of $351 million, or $3.22 per share, in 1Q23.

Adjusted earnings were $0.32 per share compared to a loss of $1.13 per share in 1Q23. The consensus had called for an adjusted loss of $0.31 per share. As discussed in a previous note, in 2023, revenue fell 1.8%, to $12 billion, while the adjusted loss was $1.13 per share, narrowing from $6.80 per share in 2022.

Recommended Action: Buy W.