I like F5 Inc. (FFIV). It offers a blend of conservative and aggressive elements in one position, which I think is befitting the questionable spot we find ourselves with market conditions, says Steve Reitmeister, editor of Reitmeister Total Return.

The aggressive part is that this is a technology company focused on cloud security and delivery solutions. The conservative part is that this is a large cap company that is kind of at the utility end of the technology space. That provides more stable earnings...but more modest growth.

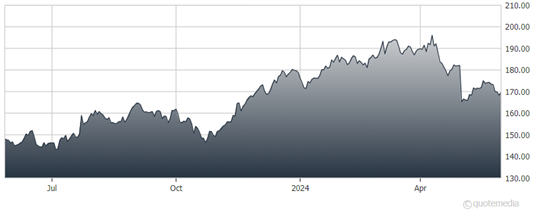

The fact that shares were up recently while the overall market was sliding lower can give you a sense of its defensive qualities that I would like in the days ahead.

The POWR Ratings also smile on these shares, with them being in the top 2% of all stocks (pointing to an A rating overall). Value is pretty impressive in the top 10%. But what really stands out is the top 2% for Quality, which is the most beneficial in finding stocks likely to outperform.

F5 Inc. (FFIV)

In the long run, this company is likely to produce around $14 in EPS next year, yet shares are trading under $170. That is less than a 12 PE in a market with an average PE over 20. This explains the slew of analyst targets above $200, including a Street-high $220 from the 5 Star analyst at Needham. That gives us ample reason to buy shares.

Long story short, I want FFIV in conjunction with more defensive/conservative positions to help shore up the portfolio as I think market downside makes more sense than upside in near term. Gladly, FFIV also offers attractive upside potential for when market conditions improve.

Recommended Action: Buy FFIV.