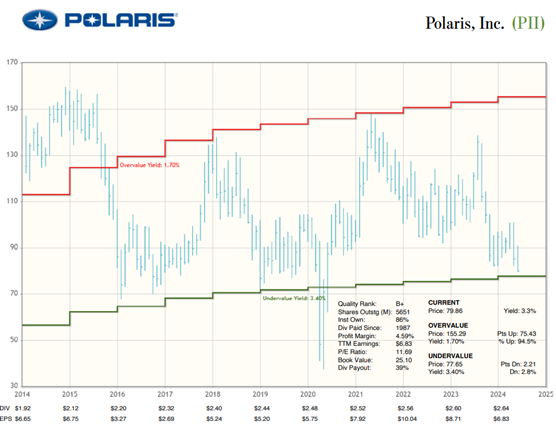

Polaris Inc. (PII) designs, engineers, manufactures, and markets powersports vehicles in the United States, Canada, and internationally. It operates through three segments: Off-Road, On-Road, and Marine. The stock has hit a rough patch lately, but it has leading brands such as Indian Motorcycles and offers a solid dividend yield which continues to grow over time, explains Kelley Wright, editor of IQ Trends.

The company offers off-road vehicles (ORVs), including all-terrain vehicles and side-by-side vehicles; military and commercial ORVs; snowmobiles; motorcycles; and motoroadsters, quadricycles, and boats.

It also provides ORV accessories comprising winches, bumper/brush guards, plows, racks, wheels and tires, pull-behinds, cab systems, lighting and audio systems, cargo box accessories, tracks, and oil; snowmobile accessories, which include covers, traction products, reverse kits, electric starters, tracks, bags, windshields, oil, and lubricants; and motorcycle accessories, such as saddle bags, handlebars, backrests, exhausts, windshields, seats, oil, and various chrome accessories.

In addition, the company offers light duty hauling and passenger vehicles; gear and apparel, such as helmets, goggles, jackets, gloves, boots, bibs, hats, pants, and leathers; and pontoon and deck boats. The company provides its products through dealers and distributors, and retail and e-commerce marketplaces.

Polaris has increased the dividend for 28 years in a row and it completed $179 million in share buybacks last year. The company was founded in 1945 and is headquartered in Medina, Minnesota. The ROIC, FCFY, and PVR are 12%, 5%, and 1.2 respectively. The Economic Book Value is $66.11 per share.

Recommended Action: Buy PII.