Orogen Royalties Inc. (OGNRF) announced royalty first-quarter revenue of almost $1.5 million, up from $1.3 million for the year-ago quarter. Revenue from prospect-generation activities fell from $940K to $437K. The company said fewer transactions were completed this year because of the state of the exploration market, writes Adrian Day, editor of Global Analyst.

The company also kept costs under control, with G&A of just below $1.4 million, down from almost $1.5 million a year ago. Working capital, mostly cash, rose to over $19 million, up almost half a million on the quarter.

While prospect-generation activities (and therefore revenue) tend to be volatile, the steady increase from the Ermitaño royalty is more important to the company’s current valuation, as well as of course its 1% royalty on AngloGold’s Expanded Silicon Deposit in Nevada.

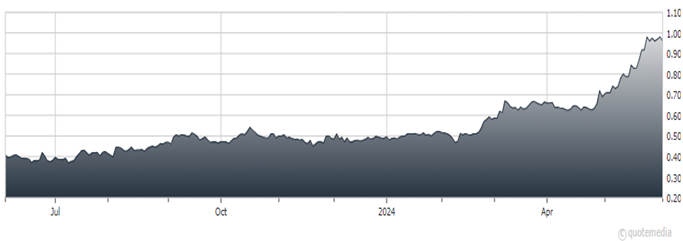

Orogen Royalties Inc. (OGNRF)

I suspect that the coming months will provide greater clarity on the eventual disposition of this major royalty. Although Orogen stock has outperformed the index this year, it is undervalued on a sum-of-the-parts basis, with free cash flow and a strong balance sheet.

Meanwhile, outflows from gold funds continue even as the gold stocks themselves move up. The largest mining ETF, the VanEck Gold Miners ETF (GDX), has experienced almost non-stop outflows over the past three months, with $974 million of net outflows over that period. Even more astonishing is the performance in April and May, with net inflows only on four days, and those very small.

Even as gold moves to new highs, investors continue to pull money out of gold mining ETFs. Despite the outflows, the GDX index has appreciated 22% in the past three months, driven, it appears, by investments into individual equities, mostly by large investors. When broad buying from smaller institutions and retail comes into the sector, the moves in the stocks could be explosive.

Recommended Action: Buy OGNRF.