I recently took the opportunity to hang out in the heart of Chicago’s financial district. I spent most of my time writing and drinking coffee sitting at the edge of the Chicago River. And of course, I did not miss the chance to snap a photo of me in front of both the Federal Reserve Bank of Chicago and the Chicago Board of Trade building. That got me thinking about the CBOE Volatility Index, notes Kelly Green, editor of Dividend Digest.

The CBOT was born in 1848 as a central location for commodities trading. This landmark Art Deco building and gateway into the financial district was completed in 1930. The CBOT merged with the Chicago Mercantile Exchange in 2007 to form the CME Group, the largest derivatives exchange in the world.

(Editor’s Note: Kelly Green is speaking at the 2024 MoneyShow Orlando, which runs Oct. 17-19. Click HERE to register)

That’s a nice history lesson, but you’re probably asking why it matters to yield investors. Stick with me here. Inside the CBOT building, the Chicago Global Markets (CBOE) new trading floor occupies 40,000 square feet. This is the home of the original 1973 trading floor that brought exchange-traded options to retail investors.

CBOE Volatility Index (VIX)

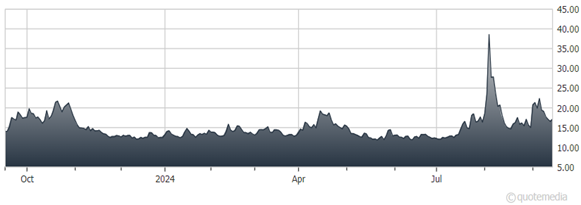

Now we get to the important part. In 1993, the CBOE Volatility Index, or the VIX, was introduced. It was originally designed to measure the market’s expectation of 30-day volatility of certain S&P 100 options prices. At the time, these were the most actively traded options on the market.

Today, the VIX looks at a weighted price of S&P 500 puts and calls over a wide range of strike prices. And it’s still one of the most watched measures of volatility today.

A VIX in the range from around 12–20 is considered normal. Anything under 12 is extra low, and above 20 should get your attention. In practice, investors don’t start to really panic until the VIX gets closer to 27–30. The index hit 89 back in 2008 and 85 in 2020. But, despite the index currently sitting in a normal range, we are certain to see higher volatility through the end of the year.

We just got this week’s Fed decision on interest rates. The Fed will have its next two opportunities to change rates in both November and December. Don’t forget that we’re also in an election year. And like with the Fed’s decision, investors are going to react no matter who wins.

Bottom line: Knowing the overall sentiment of the market will keep you from being swept up in emotional momentum.