China is the largest automobile market in the world, and the country has a thriving group of domestic manufacturers to meet demand, notes Paul Goodwin, international investing expert and editor of Cabot Emerging Market's Investor.

NIO (NIO), a Chinese designer and manufacturer of electric cars, including self-driving cars, calls itself a “next-generation car company.” It first developed an electric supercar, the EP9, which has set speed records for fastest lap times (without a driver) at U.S. and European tracks. But it’s not a street-legal ride and production is extremely limited.

In 2017, with the EP9 leading the publicity charge, NIO started selling its first production car, the NIO ES8, a seven-seater electric SUV with an onboard pilot system, an autonomous driving assistance system and what it calls “the first in-car intelligent AI system.” It has a base price of about $64,500.

NIO released its third-quarter results on November 6, and revenue results were strong, but hard to read, since it was just the company’s second quarter with any revenue at all. The company reported $6.9 million in sales in Q2, so Q3’s $214 million represented more than a 3,000% increase.

Moreover, the Q4 outlook was solid, with management expecting ES8 deliveries to total nearly 7,000 (up 110% or so from last year) and total revenues to also roughly double, at least in local currency terms. As NIO Inc.’s factory ramps up its capacity, its backlog of reservations for ES8’s stands at 15,800. It’s a good sign.

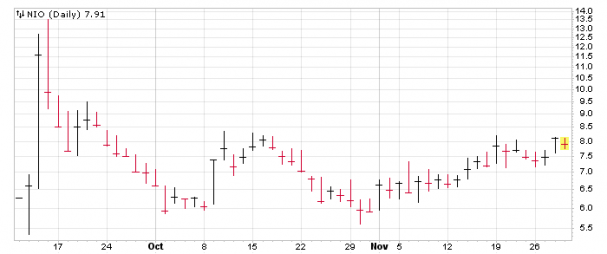

Despite a new buy signal from the Cabot Emerging Markets Timer, we still think it’s a bit too early to jump in on NIO. It is a recent IPO, with only scant sponsorship. The potential market for the company’s cars is enormous and their one product is attractive. For now, we rate the stock a "watch".