We’re ALMOST to the year-end holiday season, but Wall Street is already in a festive mood. Stocks are rising in the early going again, along with gold, silver, and crude oil. Treasuries are mostly flat, while the dollar is lower.

It’s been quite a run for the US market, with the S&P 500 gaining in 12 of the last 14 trading sessions. In fact, this is the strongest run for the index in 13 months. Even the lowly Russell 2000 Index of smaller-capitalization names has joined the fun. It’s up 5% this week, pushing it into the green year-to-date.

Meanwhile, in the wake of the Biden-Xi summit this week, the Wall Street Journal wrote about the lousy relative performance of Chinese stocks today. Their piece points out that the MSCI China Index is off 8% year-to-date, which compares very poorly to the 17.4% gain for the S&P 500 during the same period. But given the size of China’s economy – not to mention the fact it accounts for 30% of the MSCI Emerging Markets Index — it’s hard to completely avoid the influence its companies and stocks have.

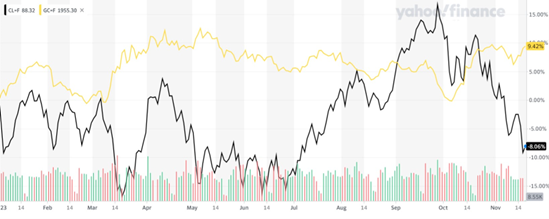

Gold Vs. Crude Oil (YTD% Change)

It has also been a “tale of two types” in the commodities market lately. Precious metals like gold and silver have rallied strongly on expectations the Federal Reserve isn’t only done HIKING rates, but might start CUTTING them again next year. Gold has risen roughly 2.5% this week, while silver has surged 8%.

Meanwhile, crude oil has been slumping amid rising energy supply. Prices are down more than 4% this week amid news US oil stockpiles have risen and demand in China has ebbed. Gold is also now handily outperforming oil on a YTD basis – by about 17 percentage points.