Stocks look poised for another rally after an incredibly powerful day yesterday on encouraging inflation news. Gold and silver are up modestly, while crude oil is off a bit along with Treasuries. The dollar is flat.

Yesterday’s tamer-than-expected Consumer Price Index helped spur the big market rally. Then this morning, the Producer Price Index that measures wholesale (rather than retail) inflation came in tamer, too. It DROPPED 0.5% in October, compared with forecasts for a 0.1% rise. The “core” PPI that excludes food and energy was unchanged, well below the +0.3% forecast.

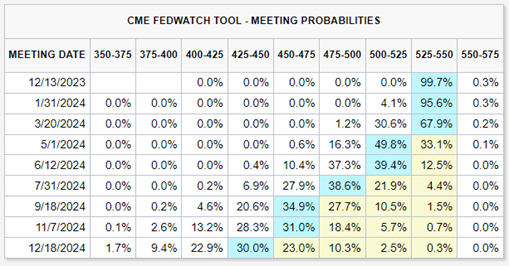

Investors have now all but eliminated bets on a Federal Reserve hike at the meeting that wraps up Dec. 13. PLUS, they’re speculating on earlier and more aggressive rate CUTS in 2024.

Take a look at this chart from the CME FedWatch Tool. Focus on the numbers shaded in light blue. That shows where rate futures traders see the most likely level of interest rates at each of the Fed’s 2024 meetings. You can see that they’re now saying the highest-probability actions are: A quarter-point cut in May...another quarter-point cut in July...and two MORE quarter-point cuts in September and December.

Can this change? Absolutely! Markets are dynamic and new economic data, Fed speeches, geopolitical developments, and more will influence where traders place their chips. But this is a BIG swing from where things stood several weeks ago, and it’s why the Wall Street Journal’s “Fed Whisperer” reporter Nick Timiraos just ran with a story called “Cooling Inflation Likely Ends Fed Rate Hikes.”

Finally, Congress averted a potential government shutdown yesterday. More than 200 Democrats joined with 127 Republicans in voting to fund the government through early 2024, leaving hard-liners to stew again.