US stocks are playing “catch down” to global equities after being closed for the Juneteenth holiday yesterday. Crude oil is lower along with gold and silver, while Treasuries and the dollar are flattish.

On the news front…

Global airlines are in a frenzy...a frenzy of airplane buying! Airlines in the Middle East, Asia, and Europe are raking in profits with the pandemic behind us and travel booming again. So, they’re ordering hundreds of jets at a time to add capacity and routes to their networks.

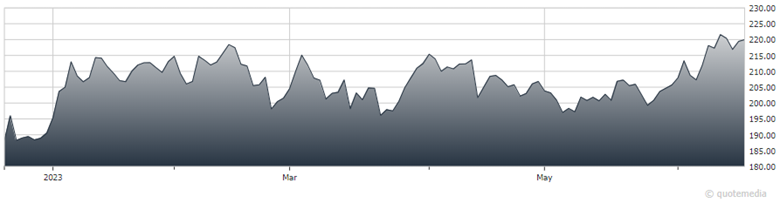

Select plane models manufactured and sold by Boeing (BA) and Airbus are essentially sold out for the next half-decade. BA shares recently broke out to the upside, leaving them up more than 12% year-to-date.

Boeing (BA)

Asian and European stocks traded lower with US markets closed yesterday. But central bankers in China aren’t sitting on their hands. They’re trying to spur the economy there by cutting interest rates again. The People’s Bank of China lowered its 1-year and 5-year benchmark rates by 10 basis points. That followed a separate rate-cutting move last week.

Yes, white-collar workers are slowly returning to the office on more workdays. But no, it doesn’t look like the pre-pandemic era in many urban cores. That’s because 5-day-per-week, in-office schedules are still rarer than back then. Kastle Systems tracks office building keycard activity and its data suggests offices are only 50% as full as the pre-COVID days in 10 top metropolitan markets.

As a result, the prices of everything from municipal bonds to shares of office-focused Real Estate Investment Trusts (REITs) remain depressed, according to the Wall Street Journal. Some riskier bonds backed by commercial mortgages trade at yields more than nine percentage points above yields on comparable Treasuries. Wider “credit spreads” are a sign investors are pricing in a higher probability of default.